The Only Bitcoin Metric That Matters (And It Isn't the Price).

Stay focused. Stay humble. Stack sats. And play the long game by embracing this metric wisely.

You’ve done it. After weeks of reading, watching videos, and wrestling with a nagging sense of FOMO, you pulled the trigger. You bought your first piece of Bitcoin.

Welcome to the rabbit hole.

You now own a slice of the most profound monetary invention in human history. A feeling of excitement, even futuristic optimism, washes over you. You download a portfolio tracker. You check it on your phone. Cool, it’s up 2%. You check it again an hour later. Oh, down 3%. Okay. You check it before bed. You check it as soon as you wake up, your eyes still blurry, reaching for the nightstand.

Within a week, you’re a wreck. You’re riding a nauseating emotional rollercoaster dictated by flickering green and red candles. A green day fills you with euphoric genius. A red day brings a gut-wrenching, stomach-dropping panic. You’ve become an unpaid, full-time, anxiety-ridden day trader.

If you’re new to Bitcoin, this scenario is likely familiar. And if it is, here is the single best piece of advice you will ever receive:

STOP WATCHING YOUR DOLLAR BALANCE EVERY DAY.

It is noise. It is a distraction. And it is actively designed to pull you into making terrible, wealth-destroying decisions.

There is only one number you should focus on. One metric that defines your success in this new financial paradigm.

FOCUS ON YOUR TOTAL BITCOIN STACK.

The Cipher: How Elon Musk's Bitcoin Journey Reveals the Billionaire's Final Trap.

Elon Musk has tweeted about Bitcoin 37 times since 2018. The world watched each one, sparking wild rallies and agonizing crashes. His every musing was dissected as either the gospel of a new financial era or the fickle whim of a bored technoking.

The Siren Song of Fiat Volatility

Our brains are not wired for Bitcoin. We are wired for immediate feedback. For thousands of years, our survival depended on reacting to short-term stimuli. That rustle in the bushes is a predator. That flash of red is a ripe berry.

The modern world has hacked this impulse. The stock ticker, the 24-hour news cycle, and now, the crypto price chart, are all designed to capture and hold your attention by feeding you a constant stream of now, now.

When you stare at the BTC/USD price, you are staring at a battlefield. You’re watching high-frequency trading bots, leveraged hedge funds, and panicked retail traders fight over the short-term price. It is pure, unadulterated chaos. It is a siren song luring you onto the rocks of bad decisions.

What are these “bad decisions”?

The Panic Sell: The price drops 20% in a day. Your $1,000 investment is suddenly $800. Your lizard brain screams, “SELL! IT’S GOING TO ZERO! GET OUT NOW!” You sell at the bottom, locking in your loss, only to watch in agony as the price rebounds a week later.

The FOMO Buy: The price is parabolic. Everyone on social media is posting rocket emojis and screenshots of their gains. Your lizard brain screams, “BUY! IT’S GOING TO THE MOON! DON’T BE LEFT BEHIND!” You buy at the absolute peak, just before the inevitable correction.

The “Clever” Trade: You think you’ve spotted a pattern. “I’ll just sell here at $60,000 and buy back in when it dips to $55,000.” You sell. It never dips. It rips to $70,000, and now you’re stuck. You either buy back in with less Bitcoin than you started with, or you sit on the sidelines, defeated.

The dollar price is noise. Trying to navigate it is like trying to build a house in the middle of a hurricane. It’s stressful, counter-productive, and you’re probably going to get hurt.

The only way to win is to refuse to play the game.

Black Friday 2025 on In Bitcoin We Trust Newsletter.

The years go by, and the Bitcoin revolution continues to progress.

The Great Reframing: Your New Unit of Account

The solution is to fundamentally shift your perspective. You need to change your unit of account.

Right now, you measure your wealth in dollars (or euros, or yen). You think, “I have $1,000 worth of Bitcoin.”

This is the old paradigm. The dollar is an inflationary asset. It is designed to lose value over time. Its supply is infinite. Governments can, and do, print trillions of it at will. Measuring your Bitcoin—a perfectly scarce, deflationary asset—in terms of an infinitely inflatable fiat currency is a logical error.

It’s like measuring a gallon of water with a leaky bucket.

The new paradigm is to measure your wealth in BTC.

Your goal is not to have more dollars. Your goal is to own a larger percentage of the finite, 21-million-coin Bitcoin network.

This mental shift is the most important step you will ever take.

When you see the price crash 30%, the old you thinks, “I just lost 30% of my money!” The new you thinks, “Wow, Bitcoin is on a 30% sale. My next purchase will get me so much more of the network.”

This is the difference between being a speculator and being an accumulator. Speculators get wrecked. Accumulators build generational wealth.

The Silent Crash: Why the Stock Market Already Collapsed and No One Noticed.

The AI bubble hasn’t “failed to pop.” The bubble is the crash. Inflation is the crisis. The government’s printing to “save” you is theft.

The Accumulator’s Game: How to Play and Win

So, how do you make this shift practical? You stop obsessing over price and start obsessing over accumulation. You play the long game.

Here is your new, four-step playbook.

1. Set Simple, Attainable Targets

Stop dreaming about a $1 million portfolio. Start focusing on your stack.

Your first goal should be simple. Maybe it’s just 0.01 BTC (1,000,000 satoshis—more on “sats” in a moment).

This is your first milestone. You work, you save a little, you buy. When you hit it, you celebrate. You now own a definable, scarce piece of the network. Then you set a new goal.

Maybe your first goal is 0.1 BTC.

Then work toward 0.25 BTC.

Then keep going.

These are your new metrics of success. Not a dollar value, but a hard-asset value. This gamifies saving and turns volatility into your friend. A price dip is no longer a source of panic; it’s a limited-time opportunity to hit your next stack goal faster.

2. Think in Satoshis (Sats)

A common mental block for newcomers is, “I can’t afford a whole Bitcoin.”

This is like saying, “I can’t afford a whole gold bar.” You don’t have to! You can buy a gram of gold or a gold coin.

Bitcoin is divisible to eight decimal places. The smallest unit is called a satoshi, or “sat.”

1 BTC = 100,000,000 Satoshis

Thinking in sats is a psychological superpower.

Buying 0.0002 BTC feels small and insignificant. But “stacking 20,000 sats” sounds like what it is: a victory. It’s the act of accumulating.

Your goal is to become a “sat stacker.” Every day, every week, every month, you add more sats to your total. This is the real game.

"Buy Satoshis, Get Rich" Is the New "Buy Bitcoin, Get Rich".

When I first got involved in the world of Bitcoin, I still remember those clickbait article headlines: “Buy Bitcoin, Get Rich”.

3. Automate Your Accumulation (Dollar-Cost Averaging)

The single most powerful tool for removing emotion and building your stack is Dollar-Cost Averaging (DCA).

It’s painfully simple: You commit to buying a fixed dollar amount of Bitcoin on a regular schedule, regardless of the price.

$50 every Friday.

$100 on the 1st and 15th of every month.

$20 every single day.

Whatever you can afford. Most exchanges and apps now let you set this up to run automatically. You set it, and you forget it.

Why is this so powerful?

It removes emotion. You never have to time the market. You never have to feel the panic of a dip or the FOMO of a pump. You are a robot. The schedule is the schedule.

It lowers your average cost. When the price is high, your $50 buys fewer sats. When the price is low, your $50 buys more sats. Over time, it smooths out the volatility and gives you an excellent average entry price.

It aligns with your life. You get paid, you automatically save a portion of that paycheck into a hard asset. It becomes a disciplined savings plan, not a gambling addiction.

DCA is the practical application of the long-term, accumulator mindset.

4. Zoom Out

Bitcoin rewards people who think in years, not days.

If you look at a 1-day chart, you will see terrifying, chaotic volatility. You will see 10% swings that make your stomach churn. This is the “noise.”

If you look at a 1-year chart, you will see a story of peaks and valleys. A wild, but ultimately directional, trend.

If you look at the 10-year chart, the noise disappears. The 1-day, 20% “crash” that gave you an ulcer is an invisible blip. The 80% bear market that lasted a year looks like a small, healthy correction.

What you see on the 10-year chart is a signal. It is the clearest, most profound signal in modern finance: the logarithmic adoption of a new, global, digital, and perfectly scarce monetary asset.

Zooming out is your shield against short-term panic. It is the visual proof that the long game is the only game worth playing.

The Final Metric

Let’s talk about the $1,000,000+ thesis.

Is Bitcoin going to $1,000,000? $5,000,000? $10,000,000? Nobody knows the future. But if you believe in the fundamental properties of Bitcoin—its absolute scarcity, its decentralization, its role as a hedge against inflation and currency debasement—then a seven-figure price isn’t just possible, it’s a logical conclusion.

Bitcoin is not a company. It’s not a stock. It is a competitor for the $14 trillion gold market. It is a competitor for the $100+ trillion bond market. It is a competitor for the $300+ trillion real estate market. It is an entirely new asset class, a global store of value, eating the world.

If you believe that thesis, even a little, the short-term price becomes laughably irrelevant.

Five to ten years from now, the only number that will matter is how much Bitcoin you actually accumulated.

When 1 BTC is worth $1,000,000, are you going to care whether you bought your sats at $60,000 or $70,000? Will you be agonizing over that one time you bought at $69,000 right before it crashed to $30,000?

No. You will not care.

You will only care that you bought it. You will only care that you held it. And you will only be filled with profound gratitude that you had the foresight to focus on your stack.

The person who panic-sold their 0.5 BTC during a bear market to “save” $10,000 will realize they traded away $500,000 of future value. The person who “cleverly” traded their 1 BTC for a $20,000 profit will realize they sold a generational inheritance for a used car.

This is your journey now. You are not a trader. You are not a speculator. You are a saver. You are an accumulator.

So, delete the price-tracking widget from your phone’s home screen. Set up your automatic DCA. Set your 0.1 BTC goal.

Stop measuring your progress in the fleeting, inflationary illusion of dollars. Start measuring it in the absolute, finite, and revolutionary new language of Bitcoin.

Stay focused. Stay humble. Stack sats. And play the long game.

Your future self will thank you.

How to Become a Bitcoin "Core Contributor" (Without Writing Code).

In the mythology of Bitcoin, there is a priestly class.

The Prophet of the “Dead End”: Why Yann LeCun’s Departure From Meta Is the Only AI Story That Matters.

LeCun is warning of architectural obsolescence. He’s saying that companies built entirely on LLM scaling may face the same fate as buggy-whip manufacturers in 1910.

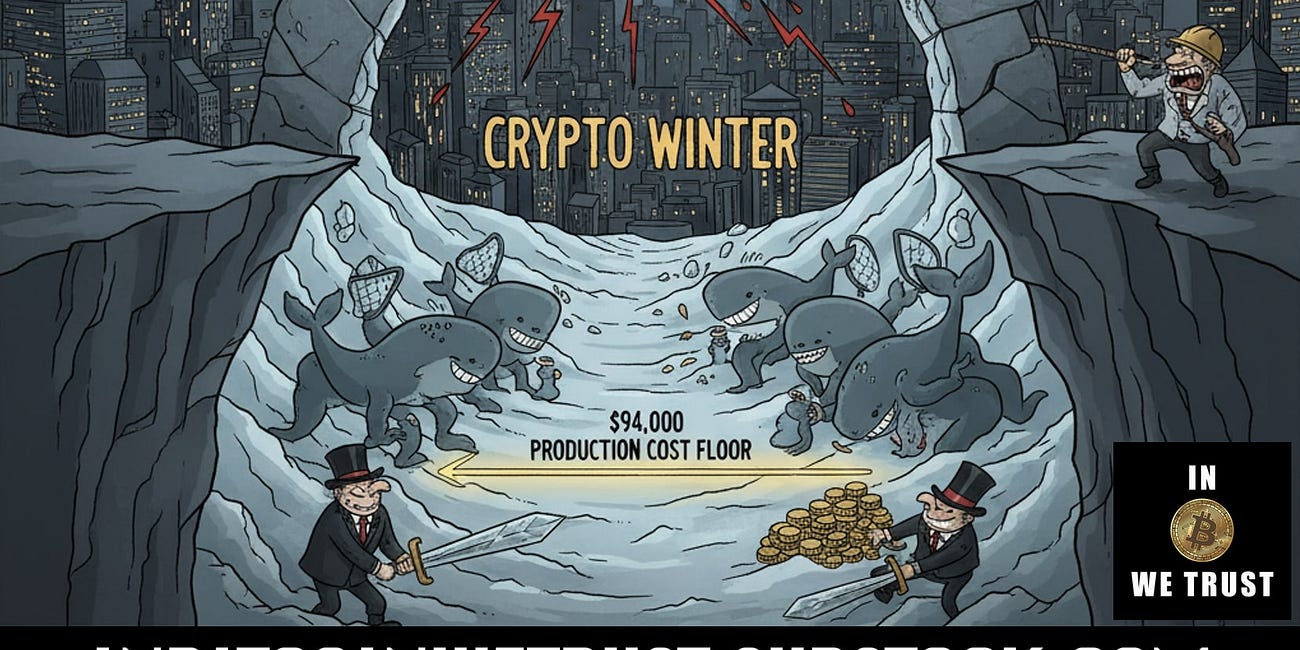

Hemorrhage Below $100,000: Bitcoin Tests Its Investors' Nerves of Steel.

The verdict is in, brutal and final. The psychological threshold, the symbolic bastion of $100,000, has fallen.

The Clockwork of Scarcity: How Money Bends Time and Bitcoin Buys the Future.

Money isn’t neutral. It is the invisible architect of our lives, the lens through which we perceive our future. Like gravity, its force is constant yet unseen, warping the very fabric of our decision-making. It bends time. In Argentina, where the peso evaporates like morning mist, people think in weeks.