Bitcoin and the Regret Trap: Why "If Only" Is Your Worst Enemy.

It's time to rethink your approach to Bitcoin.

It's a refrain we hear at dinner parties, on online forums, and in the whispers of our conscience: “If only I had bought Bitcoin in 2011...” This is followed by a quick, often bitter, mental calculation that results in an imaginary fortune of several million, or even billion, dollars. This thought, as common as it is, is one of the most sterile and destructive psychological traps in investing. It is based on a fundamental illusion: that you, the investor, would have remained a passive and stoic spectator in the face of the greatest financial roller coaster in modern history.

The argument is straightforward: a modest investment, such as $100 in 2010, would be worth a substantial sum today. However, this statement overlooks the most crucial and unpredictable variable in the equation: human nature. There is no guarantee, and every reason to believe the contrary, that you would have held on to this investment through the extreme volatility cycles that have defined Bitcoin’s history.

This article aims to deconstruct this myth of regret, not by exploring the path of Bitcoin’s price, but the emotional and psychological journey an investor would have had to endure to turn a handful of dollars into a historic fortune.

The 5-Minute Guide to Your First Bitcoin Lightning Network Payment.

If you’re a Bitcoiner, you’re familiar with the feeling. You broadcast an on-chain transaction, perhaps moving funds from an exchange to your secure hardware wallet. Then, you wait. You watch the mempool, you wait for that first confirmation, and ten, twenty, maybe thirty minutes later, you get the satisfying notification that your transaction is immutably settled in the blockchain.

The Hellish Odyssey of the Early Investor

Let's imagine the scenario. The year is 2010. You are a curious technophile, and you decide to risk $100 on this obscure “digital currency” project called Bitcoin. At this stage, it’s casino money, a fun experiment. Then, the journey begins.

Your $100 investment reaches $1,000. A tenfold increase. The dopamine flows. You feel like a genius. Then, it reaches $100,000. This is more than many people's annual salary. The temptation to sell is already palpable. Your friends and family would probably advise you to “take your profits.” But you hold on. The investment climbs to $1.7 million. At this precise moment, you are no longer an amateur. You are, on paper, a millionaire. The decision not to sell becomes an almost irrational act of faith. You could pay off your mortgage, quit your job, and secure your children's future for life. Every day you don't click “sell” is an active decision to risk this newfound fortune.

And then, the first test of courage arrives. The market crashes. Your $1.7 million portfolio melts down to $170,000. In a few weeks, you have “lost” more than $1.5 million. The panic is total. The feeling of being a genius has evaporated, replaced by the terror of being an idiot who missed his chance. The pressure to sell and “save what’s left” is immense. This is the first great filter, where 90% of investors would have capitulated.

But let’s imagine you have nerves of steel. You do nothing. And the market turns around. Your $170,000 recovers, then explodes to $110 million. The sum is so colossal that it becomes abstract. You were not only right, but your conviction has been rewarded beyond your wildest dreams. But with this new wealth comes a new fear, a hundred times stronger. You've already seen what the market can do. The memory of the fall from $1.7 million to $170,000 is etched in your mind. Selling a part, say 10 or 20 million, seems like the most logical and prudent thing to do.

Yet, our imaginary hero does nothing. He watches his $110 million portfolio shrivel down to $18 million. The pain of this loss is psychologically devastating, even if you remain incredibly wealthy. You've seen nearly $100 million evaporate. Who can endure such a thing without flinching?

The cycle repeats, each time with higher stakes: from $18M to $390M, then a drop to $85M, followed by a surge to $1.6B, then another fall to $390M, to finally reach $2.8B. Only by surviving this odyssey, by resisting temptation at every peak and fighting panic at every trough, would your initial $100 have become $2.8 billion.

Cold Statistics vs. Hot Panic: Loss Aversion

Bitcoin promoters like to cite its staggering Compound Annual Growth Rate (CAGR) of 102.79% over 13 years. This figure, while accurate, is a misleading representation of reality. It smooths over a chaotic volatility that few human psychologies can withstand. This is where the concept of loss aversion, developed by psychologists Daniel Kahneman and Amos Tversky, comes into play.

Their theory, which earned Kahneman a Nobel Prize, demonstrates that the pain of losing a sum of money is about twice as powerful as the pleasure of gaining the same amount. In the context of Bitcoin, the panic during a 70% crash is therefore much more powerful than the euphoria during a 70% gain. This emotional asymmetry is the engine of panic selling. In the face of a fall, the brain no longer seeks to maximize future gain, but to stop the immediate pain of the loss, pushing investors to sell at the worst possible time and to materialize losses that were only on paper.

Hindsight Bias and Accidental Billionaires

Regret is also fueled by hindsight bias: in retrospect, all market rebounds seem obvious. But in the heart of the storm, uncertainty is total. So how did some succeed? Often, through a paradoxical situation: forgetfulness. Early investors stored their bitcoins on a hard drive and forgot about them, finding themselves forcibly removed from the emotional arena. They couldn't sell.

The True Pioneers: Ideologues, Not Speculators

The history of Bitcoin’s early adopters confirms this: their motivations were rarely financial. They were cypherpunks, activists who saw cryptography as a tool for freedom.

Hal Finney, the first recipient of a Bitcoin transaction, was a cryptographer passionate about technological experimentation.

Laszlo Hanyecz, famous for exchanging 10,000 bitcoins for two pizzas in 2010, simply wanted to prove that the system worked as a means of payment.

These pioneers used Bitcoin; they didn't “hodl” it in the hope of getting rich. Their story is the ultimate proof that the "if only" regret is based on the false premise that we would have acted differently from them, even though they were the most informed.

Rethinking Investment: Beyond Regret

The first step is to abandon regret. It’s a dead weight. Instead, use this lesson to build a sound investment strategy, based on a golden rule: only invest what you can afford to lose. Here are some strategies to master your emotions.

1. The Dollar-Cost Averaging (DCA) Strategy

Dollar-Cost Averaging involves investing a fixed amount at regular intervals (e.g., $50 every week), regardless of the price. This method automates the buying decision, smooths out your average entry price, and protects you from the temptation to invest a large sum at the market peak out of fear of missing out (FOMO).

2. The “HODL” Philosophy

Born from a typo on a forum in 2013 (“I AM HODLING”), this term has become a philosophy: buy and hold for the very long term, ignoring fluctuations. This strategy requires absolute conviction in the future potential of the asset, or total forgetfulness. It is the strategy of the “accidental billionaires.”

3. The Strategic Profit-Taking Approach

Contrary to the pure HODL, this approach consists of defining price targets in advance at which you will sell a portion of your position (e.g., “sell 20% if the price reaches X”). Realizing concrete gains reduces stress and makes downturns more bearable, as you have already materialized part of your success.

4. Use your Bitcoin to live your life the way you want to

Bitcoin is synonymous with freedom. This means that you should never hesitate to use your Bitcoin as you wish, even if it goes against the advice of others. Bitcoin gives you back control over your life. It's up to you to take advantage of it. The Spend and Replace your Bitcoin approach fits into this framework. Don't hesitate to spend your Bitcoin with merchants that support Bitcoin. This is how you will strengthen the Bitcoin-centered circular economy that we are seeking to build. Living with Bitcoin means that you can save some of your Bitcoin and spend some of it, then accumulate it again by getting paid in Bitcoin as soon as possible. This will bring you back to the very essence of the Bitcoin system: a P2P system that belongs to all of us.

The fantasy of easy gains is an illusion. The reality of investing is a psychological marathon. Instead of dreaming of an idealized past, focus on building a more disciplined future. The past is a lesson, not a life sentence of regret.

The $1.5 Trillion Gambit: Is a Gold Short Squeeze the Secret Path to American Bitcoin Dominance?

In the grand theater of geopolitics and finance, actions on the world stage are rarely what they seem. A trade dispute can be a proxy war. A tariff can be a hidden weapon. And a seemingly arcane administrative decision can be the opening salvo in a monetary revolution. It is through this lens that we must examine a recent, and frankly bizarre, move by the United States:

Tucker Carlson, the "Most Dangerous Economist," and the Secret Engine of Our Misery.

Every so often, a conversation slices through the static of our daily news cycle and strikes at the very foundation of our reality. It doesn't just present new facts; it provides a new lens through which to see the world, revealing that the chaos we experience isn't random but a product of a hidden design.

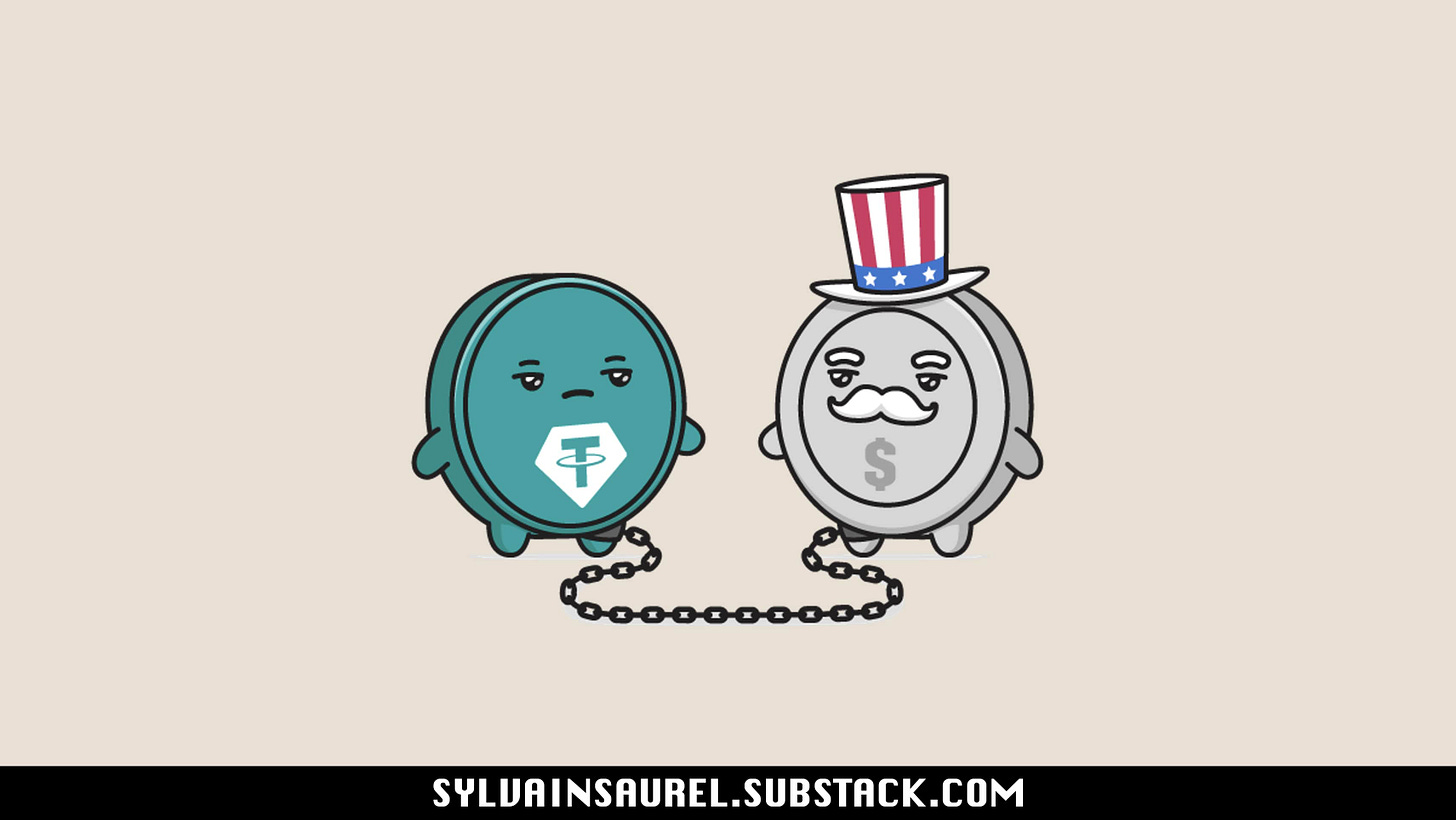

Stablecoins: The End of SWIFT?

The quiet revolution in international payments is underway.

Don't Just HODL, Participate: 4 Ways to Support the Bitcoin Network (No Terminal Window Required)

If you’re reading this, you’ve already taken the most important step. You’ve peered behind the curtain of the traditional financial system and seen the frailties. You’ve done your research, you’ve endured the condescending questions from friends, and you’ve converted some of your hard-earned value into the hardest money humanity has ever known. You are a hodler.

The best time to stsrt is always now when you plan longterm. I decided to rethink some typical rules. Would appreciate some Feedback.

https://open.substack.com/pub/bitform/p/global-risk-ranking-2025-why-bitcoin?utm_source=share&utm_medium=android&r=5yewhm