The Escape Hatch: How Bitcoin Solves the Triffin Dilemma and Saves America.

This is the new Manhattan Project, but instead of building atomic weapons, America is securing cryptographic nodes.

Your kids are broke. Your grandkids are likely to face financial struggles. And while your family struggles to navigate a financial landscape that feels rigged, the only real winners are the money printers in Washington, D.C. They play a game with rules you were never taught, and the prize is your future.

Welcome to the Triffin Dilemma—the 80-year economic curse that has been systematically hollowing out America from the inside, turning the world’s superpower into a shadow of its former self. It’s the hidden parasite that has been feeding on the American dream, leaving behind a trail of debt, decay, and despair.

This isn’t some grand conspiracy; it's a structural flaw, a mathematical trap. And understanding it is the key to understanding why everything feels so broken.

The Real Trojan Horse: How America's Debt Machine Is Secretly Fueling the Bitcoin Revolution.

In the echo chamber of modern political commentary, a tantalizing conspiracy theory has taken root. On Tucker Carlson’s widely watched platform, academic and investor Dave Collum laid out a chilling proposition: Bitcoin, the decentralized digital currency celebrated by libertarians and technologists, is nothing more than an elaborate setup.

The Devil’s Bargain: Unpacking the Triffin Dilemma

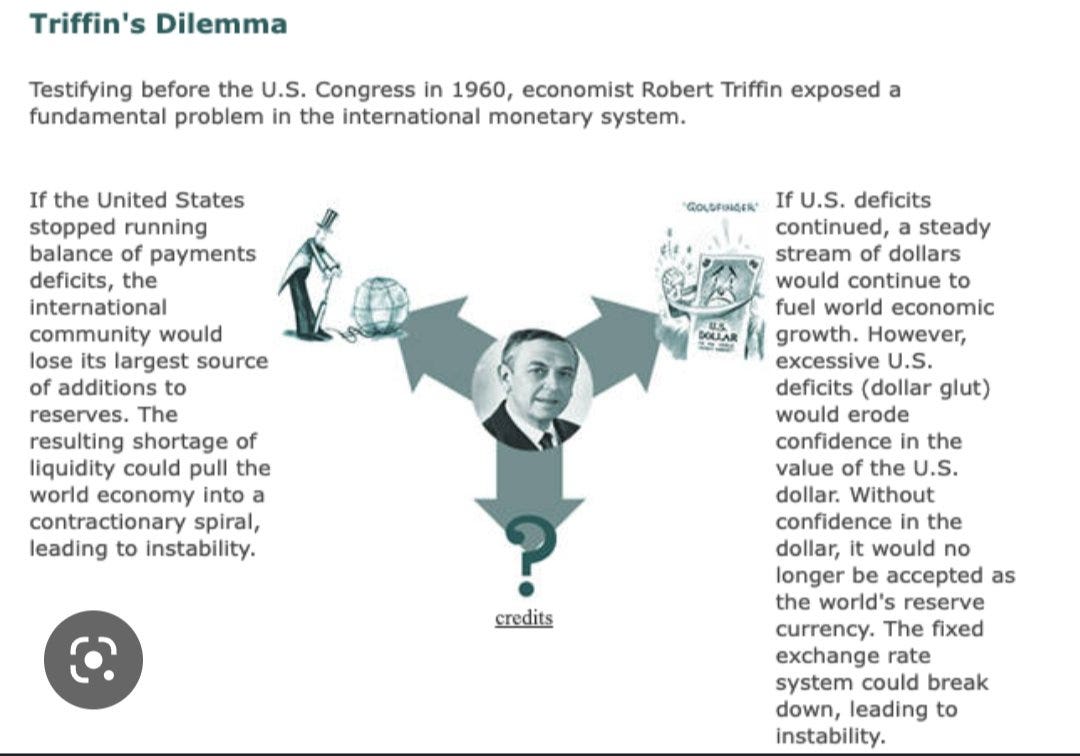

The Triffin Dilemma isn’t complicated; it’s just cursed. The Belgian-American economist Robert Triffin first identified it in the 1960s, who saw the fatal flaw inherent in the Bretton Woods system. The problem stems from the U.S. dollar being forced to play two contradictory roles at the exact same time: it must be America’s national currency, and it must also be the world’s reserve currency.

These two jobs are in direct, permanent conflict. Here’s the trap, broken down:

The World Needs Dollars (Liquidity): To function, the global economy needs a massive, ever-growing supply of a neutral asset for international trade and for countries to hold in their foreign exchange reserves. Since 1944, that asset has been the dollar. For the rest of the world to get these dollars, America must send more money out than it takes in. America does this by running a massive balance of payments deficit—buying more foreign goods than America sells (a trade deficit), spending on our military bases worldwide, and investing abroad. America is the world’s dedicated dollar factory, and our deficits are the assembly line.

The World Needs a Stable Dollar (Confidence): At the same time, for the world to want to hold and use the dollar, it must trust that the dollar will hold its value. It must be a reliable store of wealth. For this to be true, the issuer of the currency—the United States—should be fiscally responsible, strong, and not running massive, ever-expanding deficits. A country that constantly spends more than it earns and racks up astronomical debt inevitably debases its currency.

Do you see the paradox now? It is a devil’s bargain with no escape.

To satisfy the world’s need for liquidity, America must run huge deficits.

But running huge deficits erodes the world’s confidence in the dollar.

It’s a choice between a fast death and a slow one. If the U.S. were to suddenly act fiscally responsible and stop running deficits, the supply of new dollars to the world would dry up, likely triggering a global depression. If America continues on the current path—supplying the world with infinite dollars—its deficits will continue to explode, eventually destroying all confidence in the dollar and leading to a catastrophic collapse of the system.

For the last 50 years, U.S. leaders chose the slow, cancerous rot. They chose to provide endless liquidity, and in doing so, they chose to sacrifice the American industrial base, the American middle class, and the long-term solvency of the nation itself. That isn’t a theory. That is the source code of America's national decline.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.