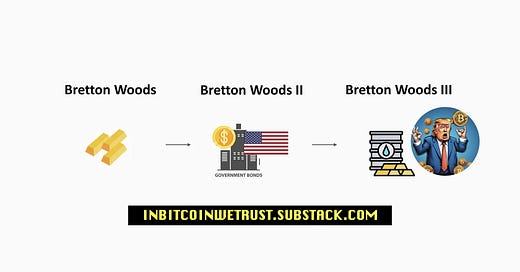

The Adoption of Bitcoin as a Strategic Reserve by Donald Trump’s America Is About To Trigger a Bretton Woods III.

The global balance of monetary power is set to change in the coming years.

We're approaching the end of 2024, and it's fair to say that this year will have changed everything in the world's perception of Bitcoin. The days when Bitcoin was seen as an enemy to be put down seem to be well and truly behind us. Since the approval of Bitcoin Spot ETFs in America at the beginning of 2024, it has become clear that things are going to change in favor of institutional and corporate adoption of Bitcoin.

Donald Trump's presidential campaign confirmed this. Even if Trump acted out of demagoguery and without any real conviction about Bitcoin, since he still confuses crypto and Bitcoin, we have to admit that having a pro-Bitcoin administration for 4 years in America is going to change a lot of things.

During his presidential campaign, Donald Trump first promised that America would keep all the Bitcoins it currently holds as a result of seizures in court cases. Surfing on this pro-Bitcoin side of the Trump administration, Cynthia Lummis quickly proposed that America should set up a strategic Bitcoin reserve to reach the million BTC held by the American government within 4 years.

This is the Bitcoin Act, which could be adopted by Donald Trump in his first few weeks in power in Washington in 2025:

With The Bitcoin Act, America Wants to Stay One Step Ahead to Maintain Its Domination of the World.

The election of Donald Trump at the beginning of November 2024 is set to usher cryptocurrency into a golden age if all the profit-hungry weak-money speculators in the USA are to be believed.

This strategy is endorsed by Michael J. Saylor, who sees an opportunity to kill two birds with one stone:

“Sell gold to buy Bitcoin. That way, the transaction will be free. On the other hand, you demonetize the gold held by our enemies. Their assets will fall to zero, while ours will reach $100,000 billion.”

I'm not convinced that it would be a good thing for the Bitcoin system for America to take control of 20 to 25% of the Bitcoin supply in circulation, as Michael J. Saylor proposes:

Should America Sell All Its Gold to Buy 25% of the Bitcoin Network, As Michael J. Saylor Suggests?

Now holding over 402K BTC with MicroStrategy, Michael J. Saylor is on a roll with a Bitcoin whose weak money price now exceeds $100K.

When it comes to passing the Bitcoin Act and buying all that Bitcoin, some are skeptical, as it will require the U.S. Congress to get on board. But for some, an even simpler solution could present itself to Donald Trump.

One that would see the Bitcoin Act passed on his first day in office, in 2025.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.