How Much Bitcoin is Generational Wealth? A Blueprint for the Digital Age.

This blueprint is not a guarantee. It is a framework based on Bitcoin's fundamental properties and a projection of its logical adoption curve.

For centuries, the concept of “generational wealth” was anchored in the tangible: sprawling estates, coffers of gold, controlling stakes in industrial empires, and portfolios of blue-chip stocks. These were the assets that could weather the storms of economic cycles, political upheaval, and the relentless march of time, ensuring prosperity for one’s children, grandchildren, and beyond. But we live in an age of profound transformation. The bedrock of our financial world is shifting from the physical to the digital, and in this new landscape, a new asset has emerged, challenging every preconceived notion of value preservation. That asset is Bitcoin.

With its unchangeable, mathematically enforced scarcity of just 21,000,000 coins, Bitcoin presents a proposition unseen in human history: absolute digital finiteness. Unlike fiat currencies, which can be printed into oblivion, or even precious metals, whose supply can increase with new mining discoveries, Bitcoin’s supply is fixed forever. This singular property has led forward-thinking individuals, families, and even institutions to ask a question that would have been unthinkable just a decade ago:

How much Bitcoin constitutes true, lasting, generational wealth?

This isn’t a question with a simple dollar-figure answer. To grasp the magnitude of what Bitcoin represents, we must stop thinking in terms of its fluctuating price in fiat currency and start thinking in terms of our proportional ownership of the entire network. The goal isn’t just to “get rich” in dollars; it’s to secure a permanent stake in the future’s global, decentralized store of value.

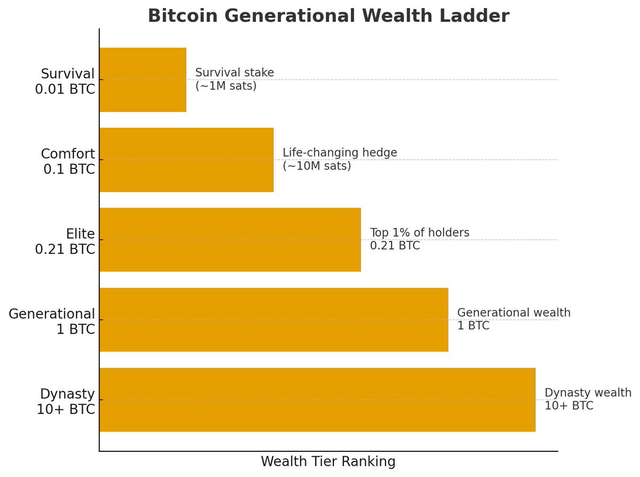

Here, we will explore a framework for understanding Bitcoin ownership, a ladder of financial sovereignty that stretches from basic survival to the establishment of a multi-generational dynasty.

The Enemy in the Mirror: Your Biggest Bitcoin Risk Isn't Who You Think.

You’ve entered the world of Bitcoin. You see the promise: a decentralized financial system, a hedge against inflation, a path to true monetary sovereignty. You’ve read the whitepaper, followed the thought leaders, and perhaps even stacked a few sats. Your eyes are fixed on the horizon, watching for the giants—the Wall Street institutions that might try to co-opt the revolution, or the governments that might try to regulate it out of existence.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.