The Enemy in the Mirror: Your Biggest Bitcoin Risk Isn't Who You Think.

Here are the 11 cardinal rules of Bitcoin self-sovereignty.

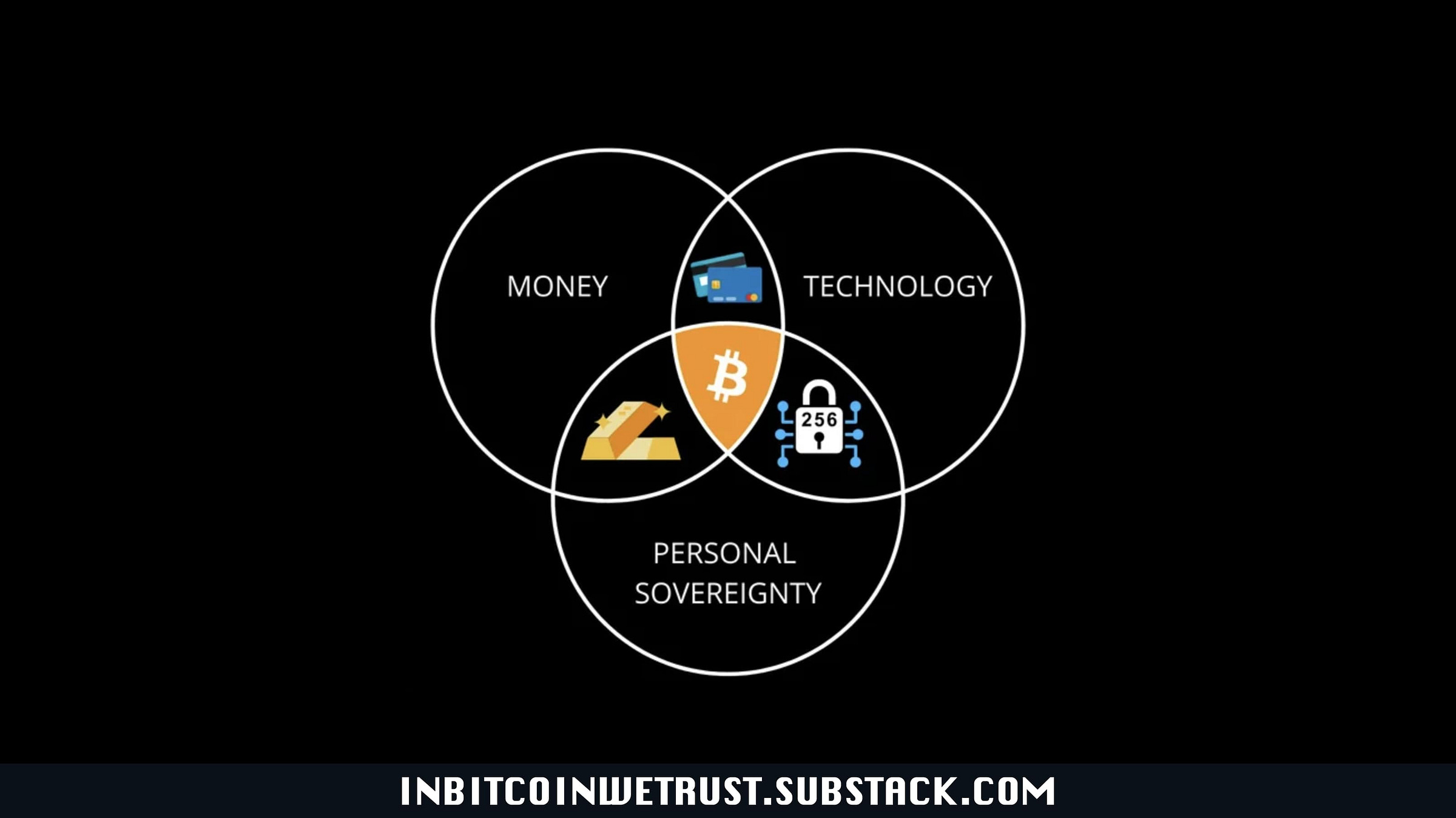

You’ve entered the world of Bitcoin. You see the promise: a decentralized financial system, a hedge against inflation, a path to true monetary sovereignty. You’ve read the whitepaper, followed the thought leaders, and perhaps even stacked a few sats. Your eyes are fixed on the horizon, watching for the giants—the Wall Street institutions that might try to co-opt the revolution, or the governments that might try to regulate it out of existence.

You believe these are your greatest adversaries. You are mistaken.

The most formidable threat to your digital wealth isn’t lurking in the halls of Congress or the boardrooms of global banks. It isn’t a state-sponsored super-hacker or a shadowy cabal. The biggest risk you face as a bitcoiner stares back at you from the mirror every morning. It’s you. More specifically, it’s you making one simple, deadly, and entirely avoidable mistake.

Bitcoin is an unforgiving technology. It grants you absolute power over your assets, a right previously reserved for kings and financial institutions. But this power comes with absolute responsibility. There is no customer service hotline to call if you get scammed. There is no “forgot password” link for a lost seed phrase. In this new paradigm, you are the bank. And if the bank is careless, the vault is emptied.

Con artists, hackers, and scammers understand this better than anyone. They don’t waste their time trying to crack Bitcoin’s military-grade cryptography. Why bother attacking the fortress when you can trick the king into handing you the keys? They prey on haste, fear, ignorance, and greed—the very human emotions that lead to catastrophic errors.

But this isn’t a reason to be afraid. It’s a reason to be prepared. By understanding the attacker’s playbook, you can render it useless. What follows are not mere suggestions; they are the 11 cardinal rules of Bitcoin self-sovereignty. Internalize them, live by them, and you will build a digital fortress that is immune to 99.9% of all attacks.

The Looming Shadow: From the Roman Denarius to Bitcoin – A Cycle of Empires and Currencies.

The whispers of history often echo the present, and nowhere is this more evident than in the rise and fall of great empires, inextricably linked to the fortunes of their currencies. From the sun-baked forums of ancient Rome to the bustling trading floors of modern New York, the story is strikingly similar:

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.