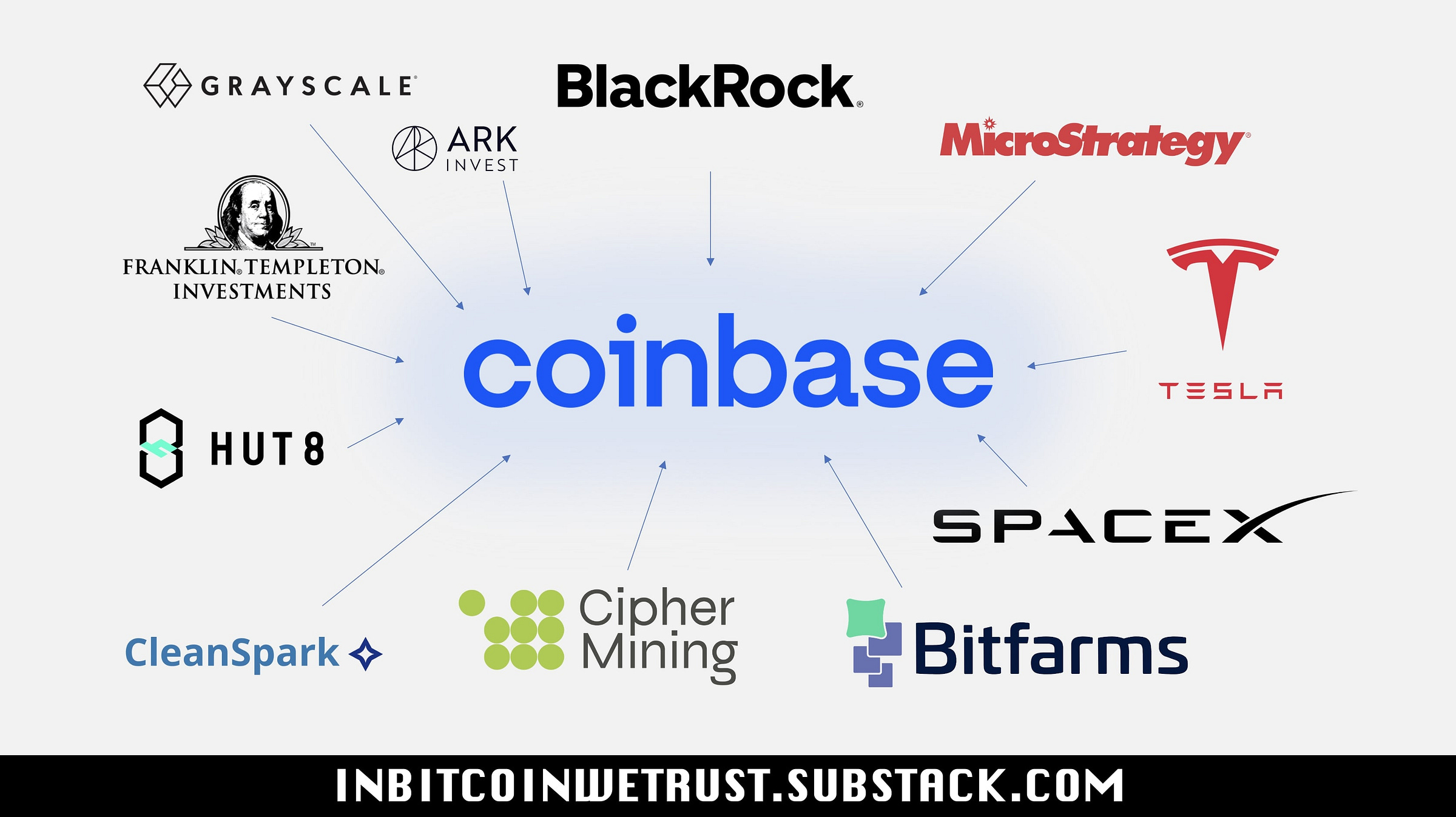

Coinbase’s Growing Weight in Corporate and Institutional Bitcoin Holdings Is a Major Risk for Bitcoin

The centralization from which Bitcoin aims to liberate us is back in the spotlight.

Bitcoin is a unique monetary revolution that highlights the importance of decentralization in enabling humans to regain power over the fruits of their labor.

Beyond money, decentralization is the key to humans regaining power in all areas.

This applies to your data, social networks, etc...

All areas are impacted, and decentralization is the key to a future where you have access to total freedom of action and expression. Bitcoin is just the prelude to a wider movement.

The problem I and others have been seeing with Bitcoin for several months now is the rise of the financial giants in the Bitcoin world.

Behind BlackRock, these financial giants are gradually stealing the very meaning of the Bitcoin revolution. BlackRock has a secret plan to take total control, as I explained a few weeks ago:

BlackRock’s Secret Plan to Take Total Control by Marginalizing the Bitcoin Revolution.

Long before Bitcoin Spot ETFs were approved by the SEC in early 2024, I was one of the few Bitcoiners to worry about the potential arrival of BlackRock, Fidelity, and other financial giants in the Bitcoin world.

BlackRock and the other financial giants are in the process of integrating Bitcoin into the current system as a simple SoV, whereas Bitcoin is intended to replace the current system. To do this, you need to think of Bitcoin as an MoE for everyday use.

This, too, is the clash of the years to come:

Bitcoin’s Clash for Years to Come Is Confirmed: MoE vs. SoV.

The price of Bitcoin in weak money is plummeting!

While pseudo-Bitcoiners rejoice in everything that's currently happening, because the only interest is to make ever more profit in weak money, you also need to open your eyes to another major risk for the future of the Bitcoin system.

This risk has only worsened since the approval of Bitcoin Spot ETFs in early 2024.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.