Buyers Have Regained Momentum in the Bitcoin Market – Even If Bitcoin Stagnates at $95K, a New ATH Seems Within Reach.

Bitcoin Price Update.

Just over a week ago, I explained that a decisive week was ahead for the price of Bitcoin in weak money. At that very moment, the price of Bitcoin was still below $90K, around $85K. But it seemed clear that the week was going to be crucial for the 5 reasons I detailed in the article:

Decisive Week for the Bitcoin Price? Here Are the 5 Things to Watch Out for This Week.

Bitcoin started the week with a weak money price, resisting well to the latest tumult of the Trump tornado. Bitcoin's weak money price is now above $87K to $88K. A new monthly high has been reached, but this must be set against low volumes. Traders await confirmation during the week to validate the uptrend that could resume. The tensions between Donald Trump and the Fed are having a major influence on the macroeconomic climate. Since the majority of investors in this market have not understood that Bitcoin is there to liberate us from this unhealthy little game, the price of Bitcoin in weak money remains dependent on it. All this benefits gold, whose price in weak money keeps breaking records day after day. The ounce of gold is now up to $3,500!

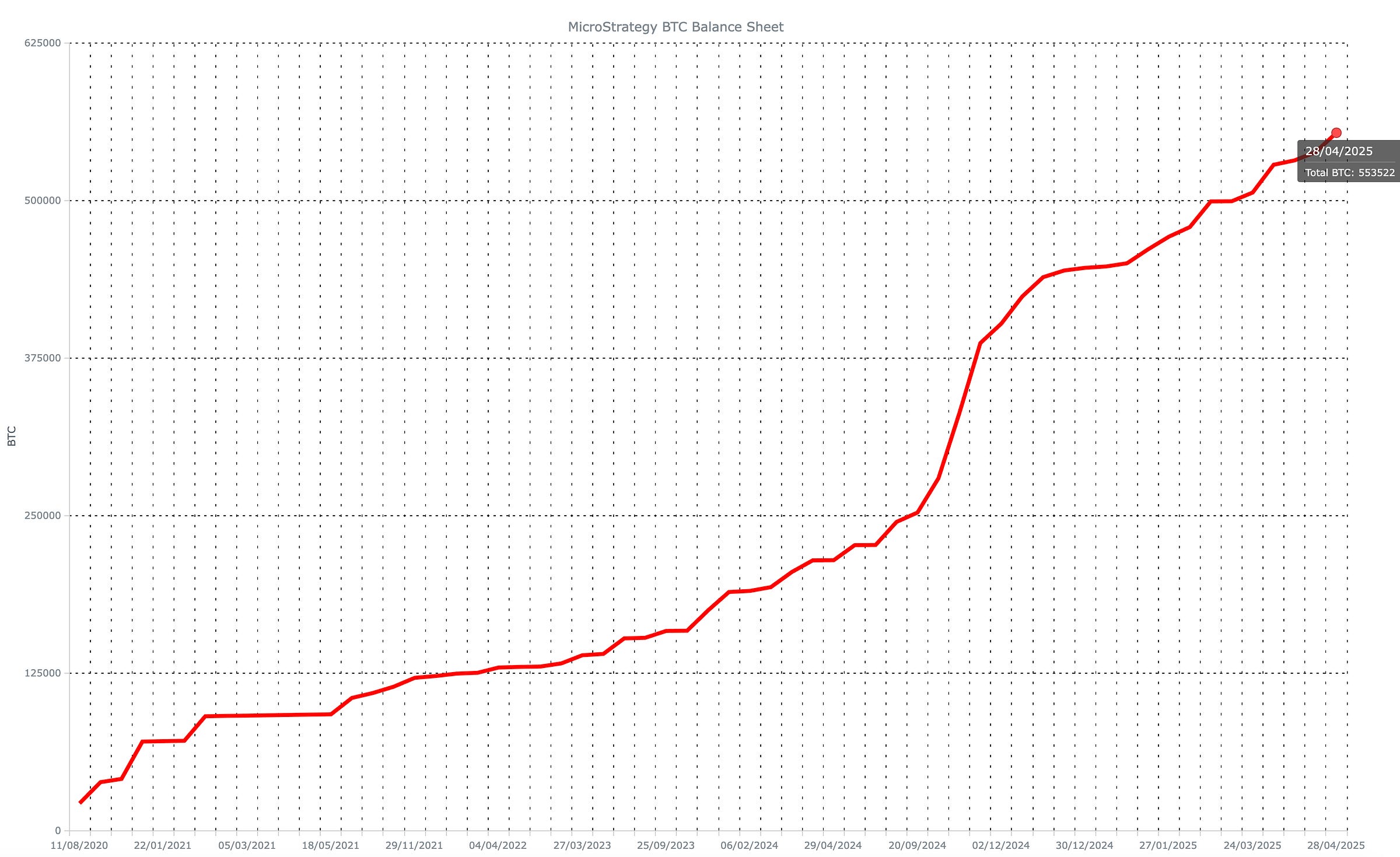

With the price of Bitcoin now hovering around $95K, there's a feeling that a turnaround is underway in the Bitcoin market. This feeling was further confirmed on April 28, 2025, when BlackRock injected nearly $1 billion into its IBIT Bitcoin ETF. BlackRock thus confirms its dominant position in the Bitcoin Spot ETF market, with over $55 billion under management. Naturally, Michael J. Saylor continued to accumulate BTC, as he has every Monday for the past several months:

MicroStrategy now holds over 553K BTC, but don't dwell on this figure - it's set to rise sharply in the future, as Michael J. Saylor doesn't intend to stop there. Don't forget that he's on an all-in strategy with Bitcoin.

In the last few hours, over $3.5 billion has been injected into Bitcoin Spot ETFs, including $3 billion in Bitcoin alone. The good news, which we'll detail below, is that the Whales now seem to be behaving in the same way as they did during the Bull Run of 2021. This could augur another ATH for Bitcoin in the weeks to come.

Let's take a closer look.

You’ve Bought Bitcoin, Congratulations! But What Does It Mean To Own Some Bitcoin?

Contrary to popular belief, it is not complicated to understand how Bitcoin works for the use that most people will make of it. It is no more complicated than trying to understand the functioning of the current monetary and financial system. Quite the contrary! In fact, it will take you years to really understand how the current system works. I would sa…

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.