Bitcoin: The End of an Era? Why Crashes and Parabolic Rises May Be a Distant Memory.

The question for every investor now is whether they are ready for this journey.

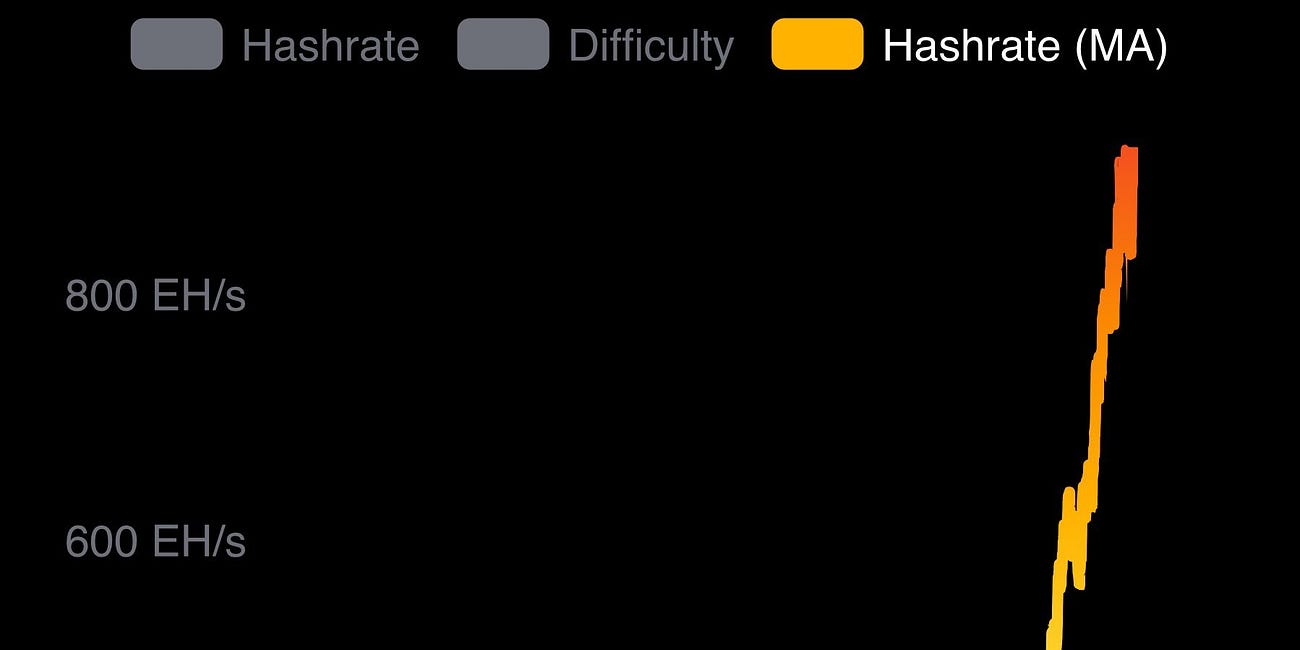

Bitcoin has long been synonymous with pure adrenaline. Its meteoric, almost vertical rises, described as “parabolic,” have created fortunes in a matter of months. And Bitcoin’s equally dizzying falls, devastating crashes that have shattered the hopes and portfolios of even the most daring investors. This extreme volatility was its nature, its DNA, the price to pay for returns that defied all traditional financial logic. However, this era —the digital Wild West, where every day brought its share of drama and euphoria —may well be coming to an end. Since the historic approval of spot Bitcoin ETFs in the United States in January 2024, the foundations of the market seem to have been irrevocably altered. Are we witnessing the end of Bitcoin's explosive cycles? One leading analyst is convinced of it, and his argument paints a radically different future for the king of cryptocurrencies.

The Golden Age of Volatility: A Necessary Reminder

To understand the magnitude of the change, we must recall what Bitcoin was like “before.” Its historical cycles were as predictable in their pattern as they were violent in their execution. Typically, some months after each “halving” (the reduction of miners' rewards by half, an event scheduled every four years), the market entered a phase of euphoria.

Institutional Investors Continue To Accumulate Bitcoin on a Massive Scale, With the Price Rebounding Towards $120K. Will Bitcoin Reach $130K?

The adoption of Bitcoin by publicly traded companies continues at a rapid pace. The number of publicly traded companies holding more than 1,000 BTC continues to increase, which could indicate growing institutional interest in Bitcoin. We have gone from 24 companies at the end of the first quarter of 2025 to 30 at the end of the second quarter, and we now have 35 to date in the third quarter:

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.