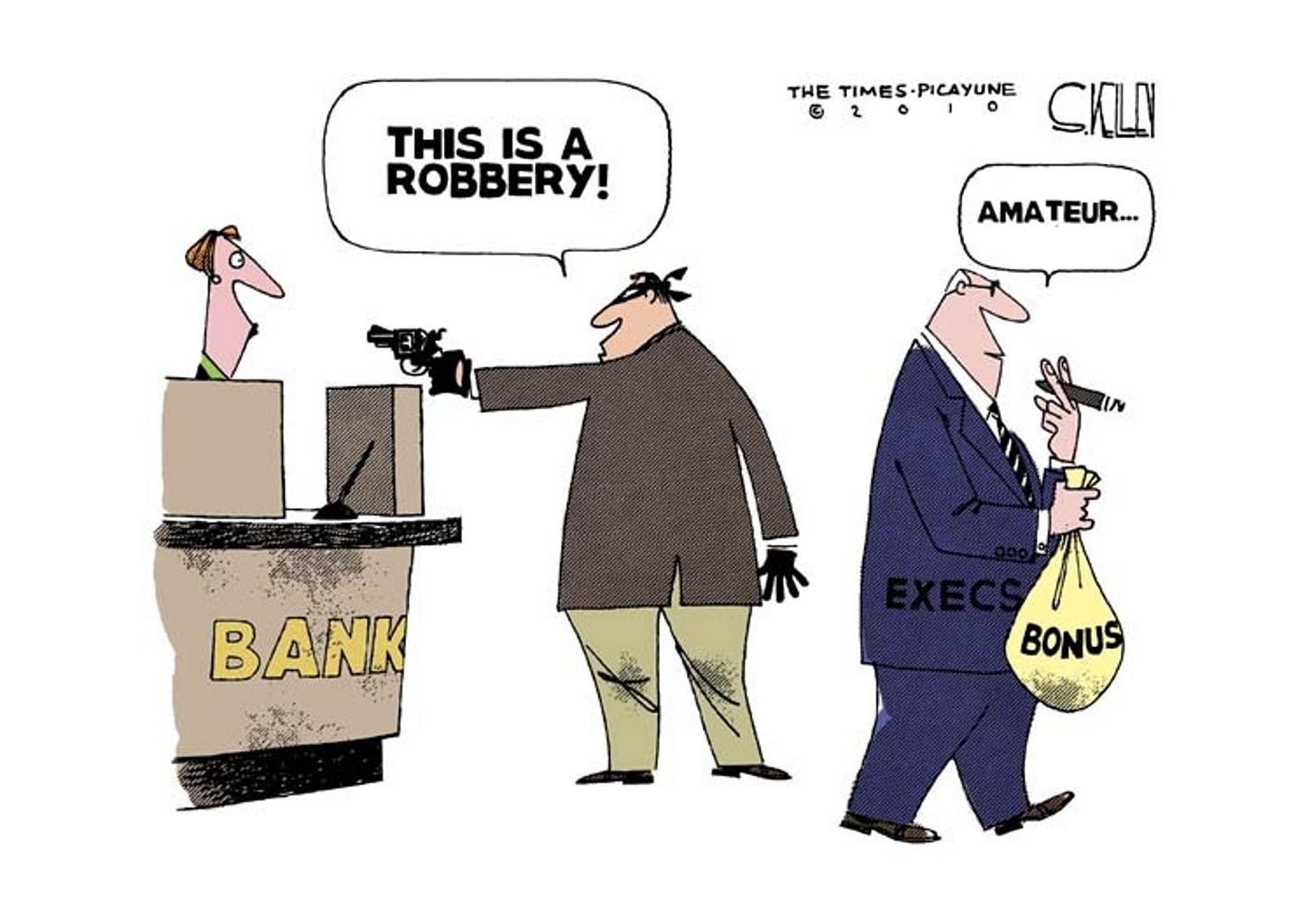

To Fight Against a Corrupt and Flawed Banking System, Bitcoin Is Your Only Weapon.

The example of Esther Freeman, whose bank is blocking her funds from her investment in Bitcoin, is the latest in a long line of abuses.

A few weeks ago, in September 2021, I drew your attention to a rather incredible figure: $332B. This figure represented the total fines paid by the world's leading banks since 2000 for violating rules in the financial services world.

The different rules violated over the last twenty years by banks such as Bank of America, JPMorgan, Citigroup, Wells Fargo, Deutsche Bank, or Goldman Sachs are diverse and varied as you can see by quickly reading the list of the main reasons that led to these penalties:

Mortgage abuses.

Fraud.

Toxic securities abuses.

Investor protection violation.

Economic sanction violation.

Consumer protection violation

Foreign Corrupt Practices Act.

Anti-money-laundering deficiencies.

Banking violation.

False Claims Act and related.

Foreign exchange market manipulation.

Price-fixing or anti-competitive practices.

Interest rate benchmark manipulation.

Tax violations.

Bank of America has been fined more than $82 billion in 20 years. The $332B figure is all the more impressive since it only represents the penalties paid by the banks and not the actual value of the damages suffered by the banks' customers.

Satoshi Nakamoto created Bitcoin to provide an alternative to the corrupt and flawed banking system

As you can imagine, for $332B of penalties, the banks have ten times more profits by their actions showing a total corruption of the banking system, but also a generalized failure.

Satoshi Nakamoto already had this in mind when he created Bitcoin, as I often like to remind people via this quote from the Bitcoin creator:

“The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.”

The fact that it is impossible to trust central and private banks has pushed Satoshi Nakamoto to create an alternative system owned by the majority. We can only thank Satoshi Nakamoto for giving us Bitcoin as a priceless gift to humanity. It is now up to us to make good use of it so that the Bitcoin revolution can come to an end.

In today's world, it is becoming clear to more and more people that there is a need for a weapon to fight the current banking system and its abuses. The latest example came from Israel in the last few days.

Esther Freeman turned a $3.2K investment in Bitcoin into just over $320K

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.