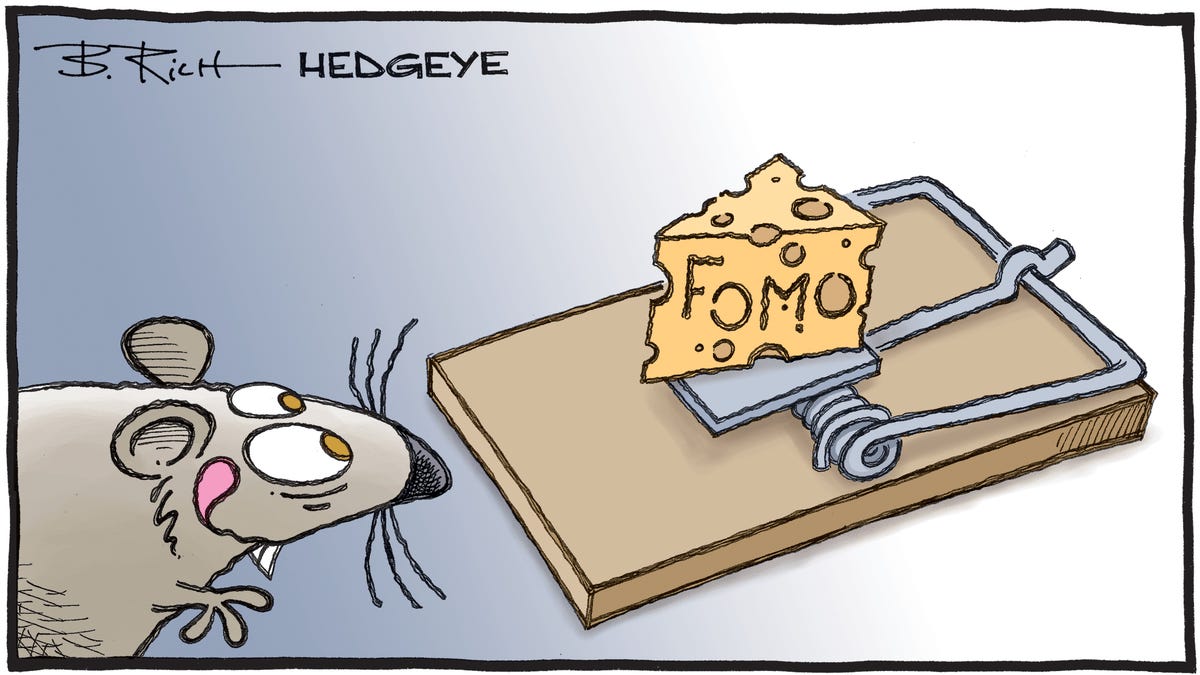

TINA Has Given Way to FOMO – Last Step Before a Stock Market Crash?

The big question is to know at what point in the bubble we are.

The bad economic news is piling up, and the US stock market is still at record highs near its recently beaten ATH (All-Time High). In the past, all this news would have been enough to trigger a crash in the stock market. Not this time.

Some people are even wondering if it could be different this time …

We've heard the phrase “This time, This is different” so many times before that we suspect that this time will be no different. Since the beginning of the COVID-19 pandemic, the central banks of the world's major economic powers have been pursuing ultra-accommodating monetary policies that have induced this level of valuation of the US stock market today.

The Fed's monetary policy has created a TINA effect

The central bank of the world's leading economic power, the Fed, has logically led the way with its monetary policy in three main areas:

Zero-interest rates.

Printing of US dollars out of thin air in unlimited quantities. More than 35% of all U.S. dollars currently in circulation have been printed in the last 18 months.

A massive injection of liquidity into the financial system via a massive asset purchase program of at least $120 billion since March 2020. This has caused the Fed's balance sheet to explode to over $8.5T.

This created a gigantic bubble in the US stock market in a TINA effect ("There Is No Alternative") that was enough to justify everything we have been experiencing for months.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.