The Whales Are Back on Bitcoin. Is $90K in Sight?

Bitcoin Price Update.

Since Donald Trump's Liberation Day at the beginning of April 2025, the days have come and gone. Trump's trade war is in full swing, with new twists and turns every day. One minute, Trump is outbidding his competitors. Next, he announces a pause or exemptions. Then, China responds to Trump's tariff blackmail. Trump responds with one-upmanship. The rest of the world stands by, hoping for a positive outcome. Sooner or later, there will be negotiations between the two giants, who will be vying for global supremacy in the years to come. The question is when.

Faced with so much uncertainty, investors don't know what to do. Whatever the market is concerned, the prevailing mood is one of expectation. Except perhaps for gold, which continues to break record after record. Gold has just exceeded $3,300 an ounce for the first time in its history. Peter Schiff is finally right about something after more than a decade of false announcements about the end of Bitcoin!

Just goes to show that anything can happen if you wait long enough. It's against this backdrop that I'd like to take a look at the Bitcoin price, with, as you'll see, the Whales seemingly finally back on the market. Is this the start of a comeback for Bitcoin's weak money price?

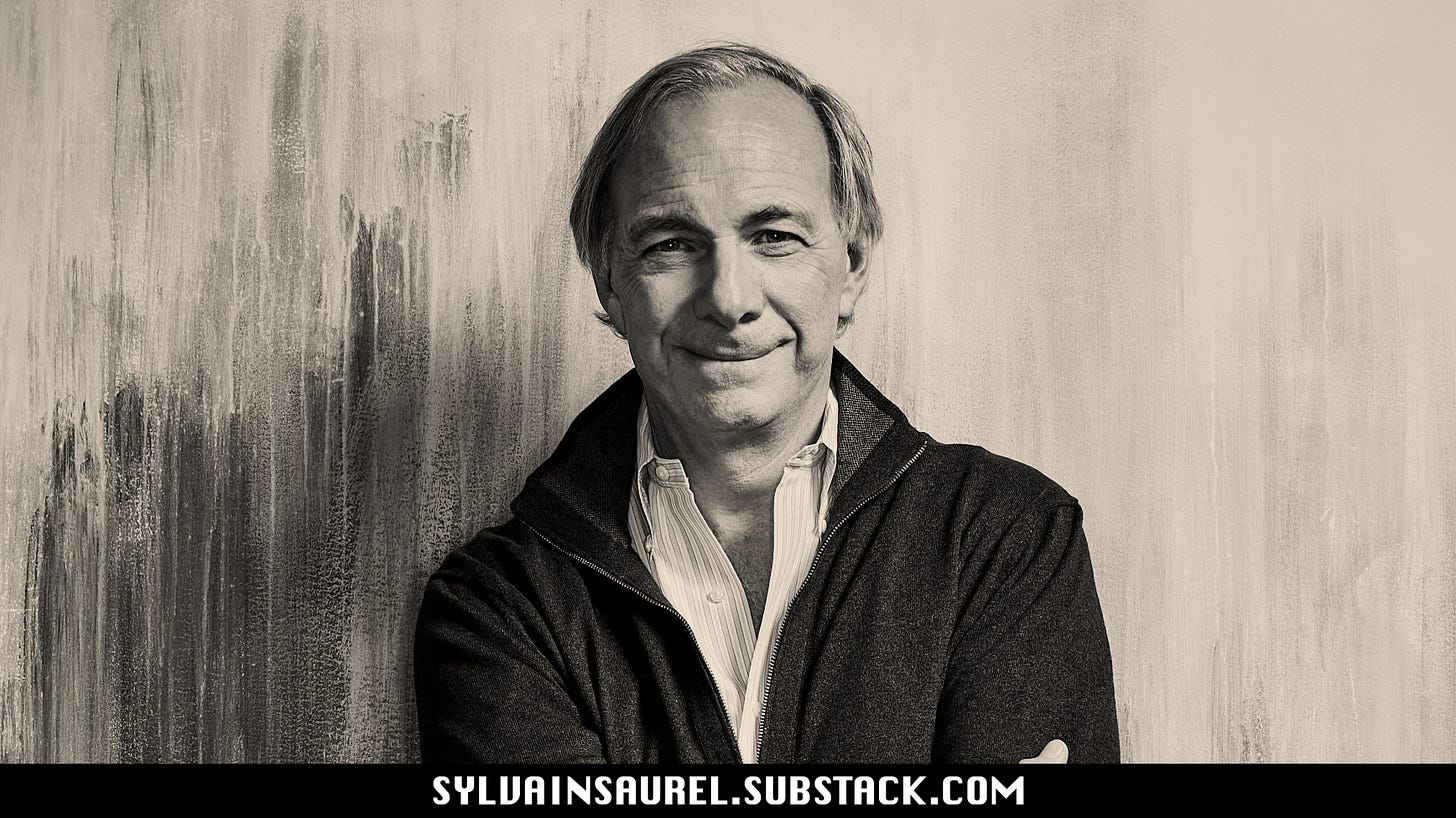

Ray Dalio’s Warning: Don’t Make the Mistake of Thinking the Current Chaos Is All About Trump’s Tariffs.

Ray Dalio takes us back to his famous Big Cycle theory behind empires' rise and declines.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.