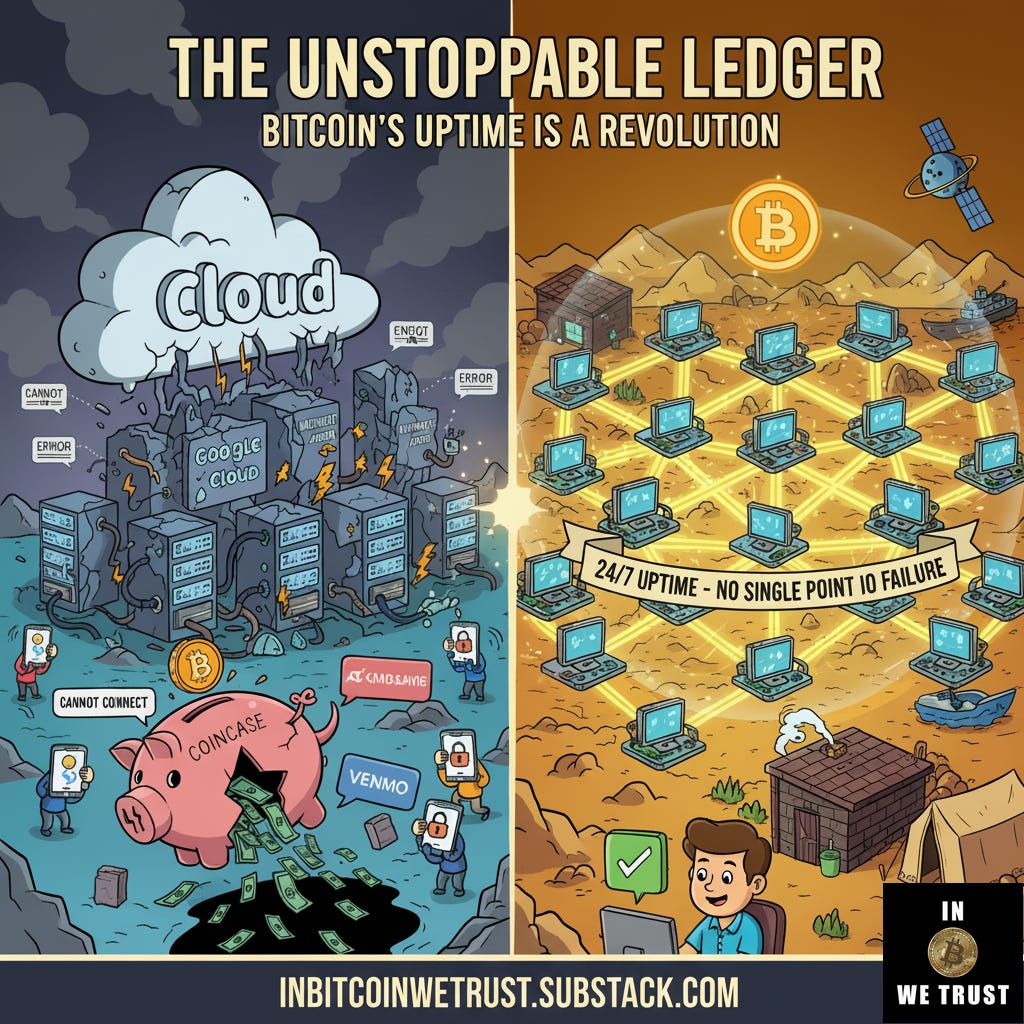

The Unstoppable Ledger: Why Bitcoin's Uptime is a Revolution.

A single failure in Amazon Web Services brought part of the modern financial world to its knees yesterday. Meanwhile, the Bitcoin network didn’t even notice.

The spinning wheel. The “cannot connect” error. The sudden, unnerving silence from the apps that run our lives.

Yesterday, it happened again. A single failure in an Amazon Web Services (AWS) data center in Virginia, and suddenly, a serious chunk of the internet simply vanished. It wasn’t just streaming sites or food delivery apps. This time, it hit our m…

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.