The Great Maturation: Why Bitcoin in 2026 Is Boring, Bureaucratic, and Bigger Than Ever.

From Casino to Collateral: Why the Boring Future of Bitcoin is Its Most Powerful Phase Yet.

By 2026, the noise has faded. The laser eyes are gone from Twitter profiles, the Super Bowl ads have ceased, and the breathless speculation about “going to the moon” has been replaced by quiet conversations in boardrooms about risk-adjusted returns and collateral efficiency.

If you are looking for the adrenaline of the 2021 bull run, you are in the wrong place. But if you are looking for the moment Bitcoin actually integrated into the global financial circulatory system, welcome to 2026.

This is the year Bitcoin stops being a “story” and starts being plumbing. The ecosystem has shifted from a casino for retail speculators to a rigorous operating system for institutions, energy producers, and sovereign entities. The revolution isn’t televised anymore; it’s being audited.

Here is the landscape of the Bitcoin economy in 2026.

Part I: The New Global Balance Sheet

From “Digital Cash” to “Neutral Collateral”

The most profound shift of 2026 is the death of the “money for spending” narrative. We aren’t buying coffee with on-chain transactions. Instead, Bitcoin has ascended to become the global neutral collateral layer.

For decades, US Treasuries served as the pristine collateral for the world. But in a fractured geopolitical landscape, assets with an issuer are liabilities. They can be sanctioned, frozen, or debased. By 2026, the market has priced in the premium of Bitcoin’s “issuerless” nature. Its primary feature is not just inflation resistance; it is that there is no CEO to call and no central bank to pressure. It is the only asset that is politically deaf.

Consequently, the “Bitcoin Standard” in the corporate world has shifted from a marketing flex to a CFO policy. Investment committees are no longer asking “Should we gamble on crypto?” They are asking, “What percentage of our surplus cash belongs in a neutral, bearer, non-sovereign asset to hedge against counterparty risk?”

This shift has changed the market structure. The marginal buyer is no longer a day trader; it is a model portfolio, a retirement channel, or a registered investment advisor rebalancing a 2% allocation. This turns ETF flows from headline news into background plumbing. Volatility still exists, but the buyer base has changed. When dips happen, they are met not by panic, but by automated buy orders from passive allocators adhering to rebalancing mandates.

The End of the “Trade”

Perhaps the most significant cultural victory for Bitcoin is linguistic. People have stopped saying “I own some Bitcoin” and started thinking “I have an allocation to digital assets.”

It sounds subtle, but it is the difference between a lottery ticket and a 401(k). Bitcoin has ceased to be a “trade”—something you enter and exit for profit in fiat terms—and has become a permanent financial instinct. It is a line item that simply belongs there, immovable and boring.

Part II: The Infrastructure of Trust

The Rise of the “BTC Treasury Operating System”

In the early 2020s, the challenge was buying Bitcoin. In 2026, the challenge is governing it.

Corporations have realized that custody (holding the keys) is relatively easy, but governance is incredibly hard. Auditability, board policy, multi-signature controls, and risk limits are the new battleground. A new software category has emerged: the BTC Treasury Operating System.

This is not an exchange. It is a tooling layer that makes holding, financing, and hedging Bitcoin feel operationally identical to holding T-bills. These platforms act as the middleware between the raw blockchain and the corporate ERP system, ensuring that a rogue CFO cannot drain the treasury and that the auditors have a real-time view of assets.

Proof of Reserves is Table Stakes

The market has moved aggressively from “show me the coins” to “show me the controls.” After the exchange collapses of the past, Proof of Reserves is no longer a bonus feature; it is the bare minimum for entry.

But the demand has evolved. The premium is now on operational integrity: segregation of assets, time-locked withdrawal policies, and attestations with teeth. This shift will likely be cemented by a major failure in 2026—not necessarily of the largest player, but a meaningful custodian. The lesson drawn from this failure won’t be “self-custody solves everything” (a niche view), but that institutional key governance is a formal discipline, akin to SOC 2 compliance for data.

Asymmetric Regulation

Regulation has settled into a predictable but harsh rhythm. It is asymmetric: friendly to transparent rails, and hostile to opaque intermediaries. The middle ground—custodians, lenders, and brokers that cannot prove their controls—is being squeezed out of existence.

We will likely see a major corporate blow-up involving debt or liquidity rollover, serving as a cautionary tale. The market will harshly learn the difference between “holding Bitcoin” and “leveraging Bitcoin.” This will force a retreat to spot-holding and a suspicion of yield-generating products that obscure the underlying risk.

Part III: The Industrialization of Mining

The Capital Discipline Era

The days of “plug-in machines and pray” are over. The 2020–2022 vibe of “grow hashrate at all costs” has been replaced by the “Capital Discipline Era.”

Miners in 2026 are indistinguishable from power traders and asset managers. Their edge is no longer just finding cheap rigs; it is financing structure, tax strategy, procurement timing, and inference flexibility (switching between mining and AI compute).

Energy Politics as the Constraint

Hashrate growth is no longer correlated strictly with price; it is correlated with energy politics. The binding constraints are grid interconnection queues, local permitting, and transformers. The best miners are not the ones with the deepest pockets, but the ones who can navigate the bureaucracy of the power grid to “energize” their sites.

This has led to the consolidation of hosting into “Trust Brands.” In previous cycles, all hosting looked the same until the bear market hit and machines disappeared. In 2026, brand equity equals risk management.

The Hybrid Model

The most profitable miners are boring hybrids. The pure-play “we just mine Bitcoin” model is being outcompeted by operational stacks that look like energy companies. These operators utilize hosting, self-mining, hedging, curtailment (selling power back to the grid), heat reuse, and capacity market payments.

Furthermore, mining has become hedgeable. Liquid markets for hashrate, difficulty, and hashprice have matured. Miners can now hedge non-price risk, driving down their cost of capital. This shifts mining from a speculative play on Bitcoin’s price (high beta) to financeable infrastructure with predictable cash flows.

Family offices and corporates are now entering mining not to “get rich,” but as a compliant way to dollar-cost average (DCA) into Bitcoin at scale, utilizing tax incentives and operational leverage to acquire coins below market price.

Part IV: The Economics of Blockspace

Fees as “Security Revenue”

The debate over high fees has ended because the framing has changed. In 2026, a fee spike is no longer seen merely as “bad UX”; it is recognized as “security revenue.”

The public finally understands that fees are not a bug—they are the long-term economic model of the network. When fees spike, mainstream headlines shift from “Bitcoin is failing” to “Bitcoin is expensive because it is valuable.” The fee market becomes legible to the public, and high fees are the signal that the network is being used for high-value settlement.

Ordinals and the Revenue Line

The “culture war” regarding Ordinals and inscriptions has faded. The moral arguments about “spam” have been silenced by the practical outcome: revenue. Ordinals have evolved into a reliable revenue line for miners, increasing the security budget and creating fierce competition for blockspace.

Lightning and the Niches

Meanwhile, the Lightning Network has quietly settled into its true product-market fit. It isn’t trying to be Visa for everyone. It has become the default rail for a specific niche: instant settlement between known micro-vendor counterparties.

B2B and internal treasury movements remain on the main chain (L1), where security is paramount. Lightning dominates the high-frequency, low-trust margins.

Part V: The User Experience of 2026

Boring Integration

Adoption in 2026 doesn’t look like a wave of people getting “orange-pilled.” It looks like a checkbox.

Payroll providers, accounting systems, and merchant processors have quietly added Bitcoin options to their backends. Users aren’t downloading complex wallets; they are clicking “Pay in BTC” or “Save 5% in BTC” within apps they already use. The integration is boring, invisible, and ubiquitous.

Stablecoins as the Trojan Horse

Paradoxically, stablecoins have done more to accelerate Bitcoin adoption than Bitcoin itself. By normalizing on-chain habits—using wallets, understanding settlement, managing keys—stablecoins have created a generation of “financially internet-native” users. These users, comfortable with the rails, eventually seek the best form of money to store on those rails. They come for the USD stablecoin; they stay for the BTC store of value.

The Bifurcation of Custody

Self-custody UX has made a quantum leap with better key recovery models and assisted multisig, making “be your own bank” viable for the upper middle class. However, the world has bifurcated. We now have a clear split: “Sovereign Individuals” who hold their own keys, and the mass market/institutions who rely on professional, regulated custody. Both models thrive in parallel, serving different needs for different risk profiles.

Final Thoughts: The Quiet Giant

By 2026, the “Old Narratives” have died. The “Get Rich Quick” crowd has moved on to the next shiny object. The original builders—those who articulated Bitcoin as infrastructure, collateral, and sovereignty—are the ones left standing.

Bitcoin in 2026 is less exciting, less volatile, and less noisy. But it is infinitely more powerful. It has successfully transitioned from a speculative experiment to a boring, bureaucratic, integral component of the global financial engine.

It turns out that the moon isn’t a destination. It’s just a rock that stabilizes the tides. And in 2026, Bitcoin is the rock.

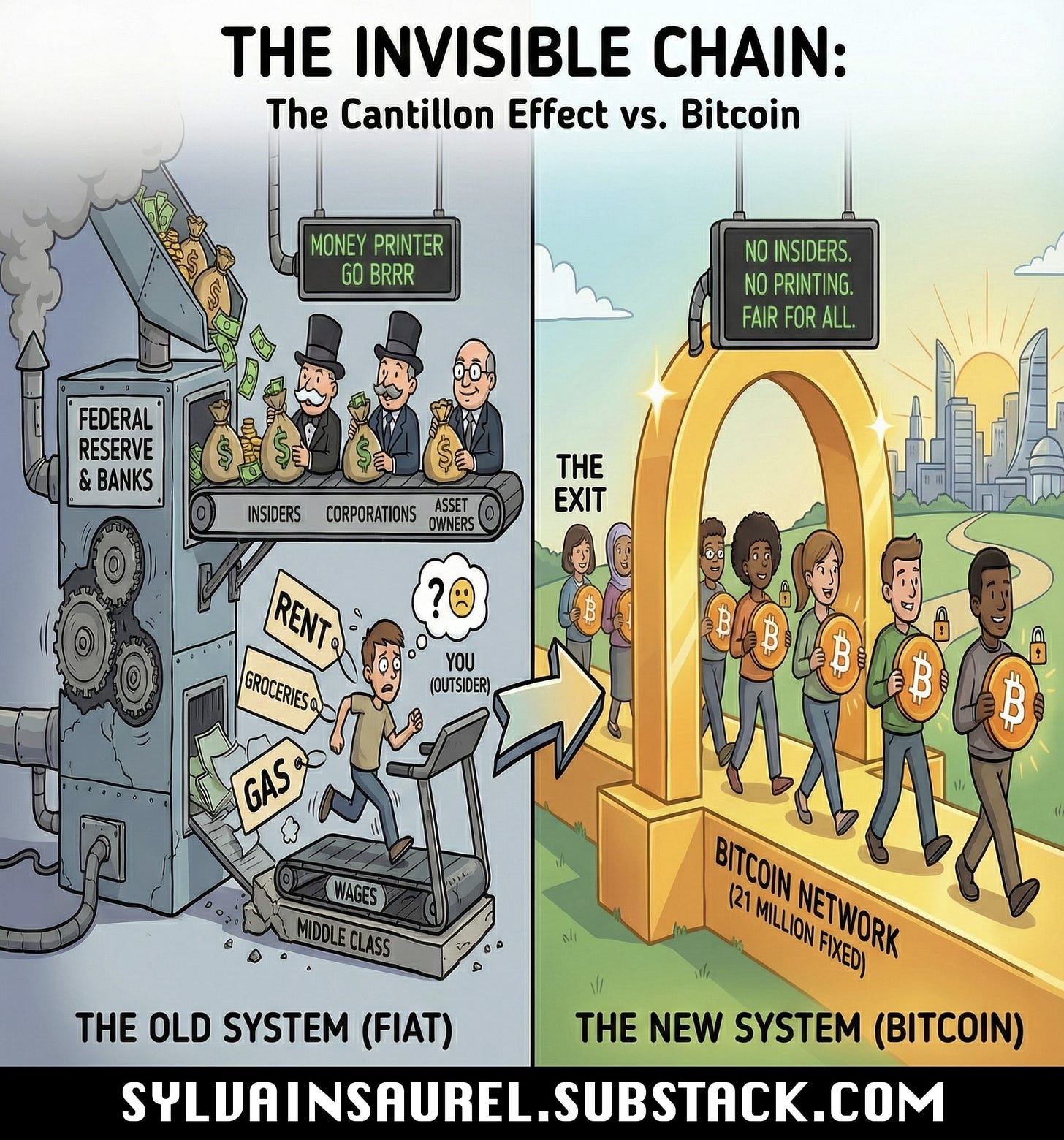

The Invisible Chain: Why The System Is Working Exactly As Designed (Just Not For You).

How the Cantillon Effect silently siphons your wealth—and how Bitcoin breaks the cycle.