The Fed Is Deepening Its Losses, but Don’t Worry the Fed Won’t Go Bankrupt, Because It Makes the Rules of the Game.

To get out of this failed fiat system for free, you know you have to play the Bitcoin card.

During September 2022, the Fed's revenues went into negative territory for the first time in years. The Fed is suffering the consequences of its restrictive monetary policy applied for several months. It is a choice assumed by the Fed which wants to do everything to curb inflation even if it means causing a recession in America.

Now that the subject of the Fed's losses is on the table, some people are wondering if these losses may have more serious long-term consequences. By more serious consequences, I mean could the Fed risk bankruptcy.

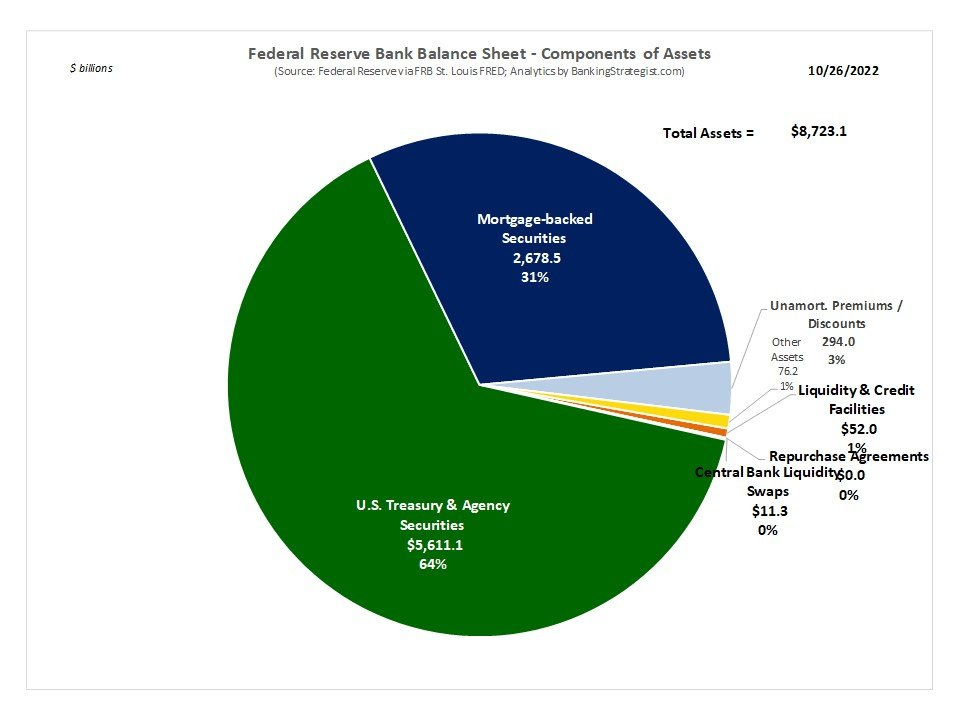

But let's start at the beginning. First, let's define what the Fed's balance sheet is and what it is made up of. The Fed's balance sheet is mainly composed of the following assets:

Government bonds.

Mortgage-backed securities.

Here are the details of the assets that make up the SEC's balance sheet as of October 26, 2022:

Government bonds are debts or claims issued by the government. They are used to finance government spending. Mortgage-backed securities (MBS) are valued by a pool of mortgages and the interest rates paid on the mortgages.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.