The "Failed" Deflation Trap: Lessons from History and Why Bitcoin is Different.

Unmasking the Debt-Driven Myths of the Past and Embracing the Dawn of the First Sovereign Productivity Standard.

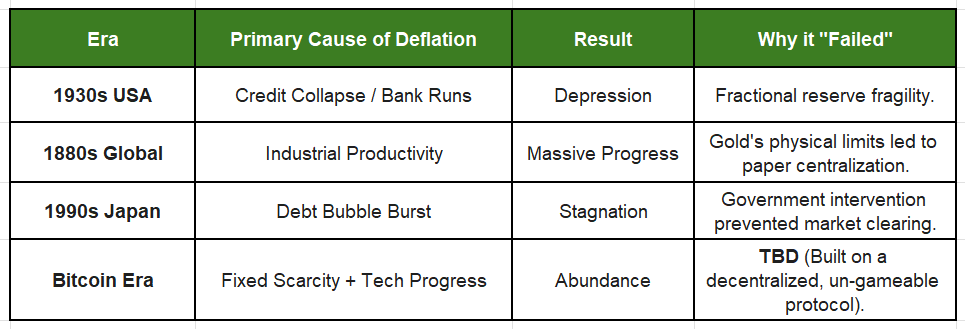

The psychological war against deflation is fueled by three historical boogeymen: the Great Depression, the 19th-century “Great Sag,” and Modern Japan.

Economists point to these eras as “proof” that when prices fall, society collapses. But if you look closely at the gears of these systems, you realize that deflation didn’t cause the failure—the structural flaws of the monetary systems themselves did. Specifically, these systems were built on rigid debt, fragile banking, and centralized manipulation.

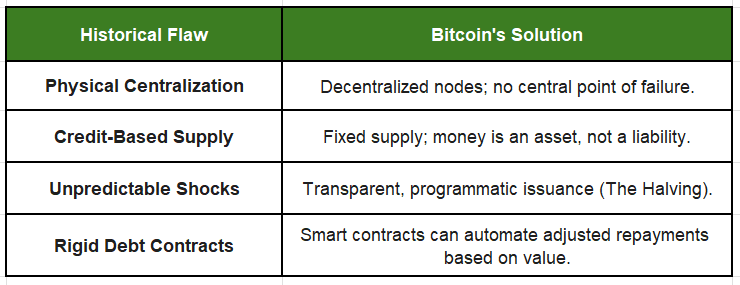

Bitcoin isn’t just a new asset; it is a fundamental redesign of money that bypasses the structural traps that turned historical deflation into “disasters.”

The Silent Architect: How Apple Accidentally Built the Most Practical AI Infrastructure on Earth.

How Apple bypassed the GPU arms race to build the silent infrastructure for the local intelligence revolution.

1. The Great Depression (1929–1933): A Debt-Deflation Spiral

The most common argument against deflation is the 25% price decline during the Great Depression. However, this wasn’t a “free market” deflationary success; it was a debt-based collapse.

The Structural Flaw: Fractional Reserve Fragility

The 1920s were built on massive credit expansion. When the stock market crashed, the fractional reserve banking system imploded. Because the money supply was tied to bank loans, as banks failed, the money literally vanished.

The “Spiral”: People rushed to withdraw cash, banks didn’t have it, they called in loans, businesses went bust, and the money supply contracted by 30%.

Why it hurt: The deflation was unanticipated and violent. Debt was fixed in dollar terms, but the dollars themselves became 30% harder to get.

How Bitcoin Bypasses This

Bitcoin is not credit. It is a base-layer asset.

No Counterparty Risk: In the 1930s, your “money” was a bank’s promise. In Bitcoin, your money is a private key on a blockchain. If a Bitcoin exchange fails, the Bitcoin itself doesn’t vanish; the global supply remains 21 million.

Full Reserve vs. Fractional: Bitcoin enables a world where money is an asset, not a debt. You cannot have a “bank run” on the Bitcoin protocol that causes the supply to shrink. The supply is immutable.

2. The “Great Sag” (1870–1890): The “Good” Deflation They Forgot

Historians often call the late 19th century the “Great Deflation,” yet it was one of the most prosperous periods in human history—the Second Industrial Revolution.

The Structural Flaw: The Gold Supply Constraint

Under the Gold Standard, the economy was growing faster than the gold supply. While this led to falling prices (abundance!), it created political friction.

The Silver/Gold Conflict: Farmers and debtors hated deflation because their debts (in gold) stayed high while their crop prices fell.

Centralization: The system still relied on central vaults and paper proxies. Eventually, governments realized they could just “break the link” to gold to print more money, which they did during World War I.

How Bitcoin Bypasses This

Bitcoin is digitally native and infinitely divisible.

Global Portability: Gold was hard to move, which led to the creation of banks and paper “promises” (which eventually became fiat). Bitcoin can be sent around the world in minutes. You don’t need a central vault to hold it for you.

Programmatic Predictability: Gold supply depends on mining discoveries. Bitcoin’s supply is known for the next 100 years. This allows markets to anticipate deflation and price it into long-term contracts, removing the “debtor’s trap” that plagued the 1800s.

3. Japan’s “Lost Decades”: The Zombie Economy

Japan is the modern “scary” example. Prices have been flat or falling for 30 years, and growth has been sluggish.

The Structural Flaw: The “Zombie” Intervention

Japan’s problem isn’t deflation; it’s the refusal to let the market clear.

Propping up Failures: The Japanese government used massive debt to keep “zombie” banks and companies alive.

The Demographics Trap: An aging population, coupled with a rigid, seniority-based corporate culture, stifled innovation.

Inside the System: The “stagnation” is measured in GDP—a metric that rewards spending and punishes saving. By human standards, Japan remains one of the safest, most technologically advanced, and stable societies on Earth.

How Bitcoin Bypasses This

Bitcoin is a permissionless market.

Creative Destruction: In a Bitcoin-based economy, there is no “lender of last resort” to print money and save a failing company. Bad businesses are allowed to fail, and their resources (capital and labor) are recycled into better ones.

Separation of Money and State: No government can “print” its way out of a demographic crisis using Bitcoin. It forces honest accounting and long-term planning.

4. Why History Failed (and Bitcoin Won’t)

Historical “deflationary” episodes failed because they were either violent corrections of previous inflationary bubbles or constrained by the physical limitations of gold.

The Abundance Shift

In every “failed” historical example, the system was trying to fight the natural trend of technology making things cheaper. Bitcoin is the first system that leans into it.

In a Bitcoin world, as technology makes food, energy, and housing easier to produce, the price of those things should drop. This isn’t a “spiral”; it’s the definition of abundance. The only reason we find it scary is that we are currently living in a system that requires constant “growth” (inflation) just to pay back the interest on yesterday’s debt.

Final Thoughts: The End of the Training

You were trained to fear deflation because it is the only thing that can kill the fiat printer. But as history shows, when the “system” fails during deflation, it’s the plumbing that was broken, not the concept of falling prices.

Bitcoin provides the plumbing. It gives us a way to have a free market where saving is a virtue, and the fruits of human progress are actually passed down to the people, rather than being inflated away to pay for the mistakes of the past.

Comparison of Deflationary Eras

The Great Decoupling: Why the Chaos of 2026 Has Only One Winner.

How 1% Rates, 100% Tariffs, and the End of Fed Independence Are Engineering the Ultimate Wealth Transfer.

Quantum Computing: The Great Illusion of Progress.

Separating the Billion-Dollar Hype from the Zero-Utility Reality.