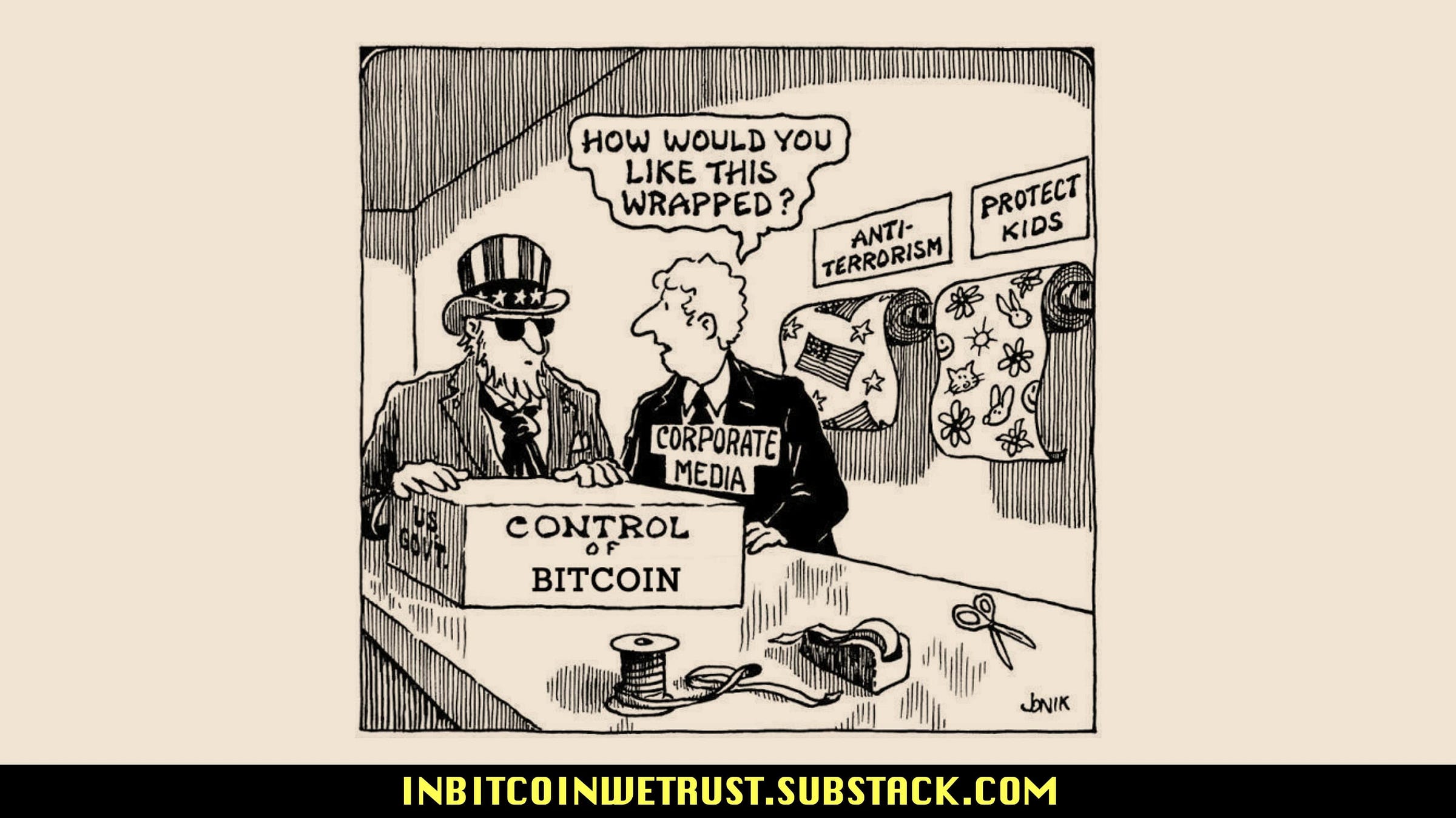

Some Musings on the Risk of Centralization of the Bitcoin System As America and Other Nations Probably Get on Board in the Coming Years.

What will be left for the people of this unique monetary revolution that is Bitcoin?

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.