Here’s Why Bitcoin’s Programmatic Monetary Policy Is Superior

More and more people will open their eyes to this reality in the future.

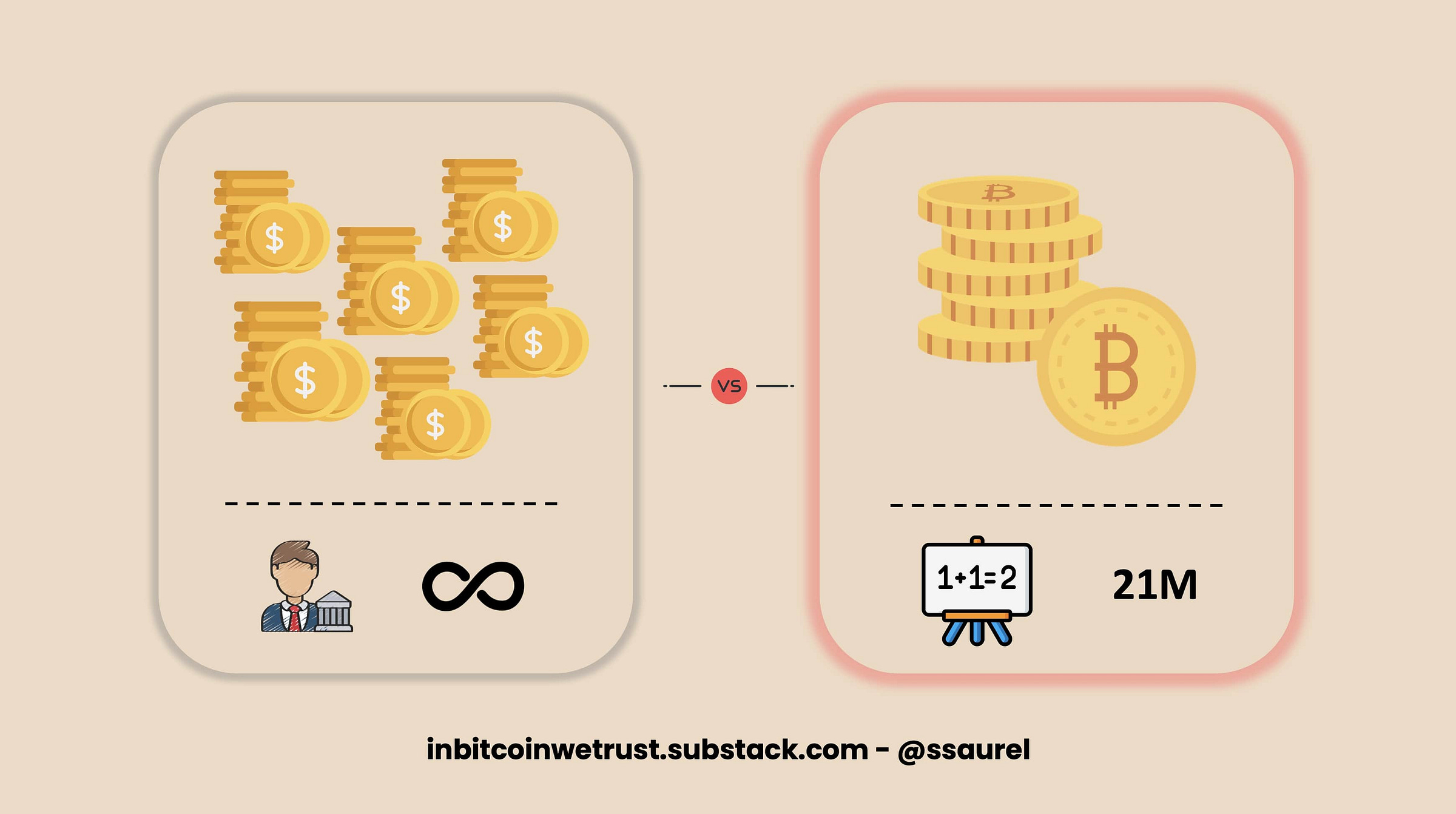

In the current monetary and financial system, central banks play a predominant role. They have been at the center of the game since the current system was established in August 1971 by Richard Nixon. The fact that they can create as much fiat money out of thin air as they deem necessary explains why their role is crucial.

As the central bank of the world's largest economy, the Fed has an even more important role. It is the one that prints out of thin air the US dollar, which is the world's reserve currency.

Thus, each meeting of the Fed's Federal Open Market Committee (FOMC) is feverishly awaited by all financial markets. Investors know that it is what the Fed decides that will determine the strategy they will have to adopt in the weeks and months to come.

The adage “Don't Fight the Fed” is not an empty word.

Everyone waits feverishly for each FOMC meeting to find out what the Fed has decided

When the Fed decides to raise interest rates, investors know that it will soon be time to leave the stock market and return to U.S. Treasury bonds. When the Fed lowers rates to zero as it did in March 2020 to combat the effects of the COVID-19 pandemic, investors know that a big stock market party is coming.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.