Bottom Seems In for Bitcoin Price – Crucial Resistance at $46K Is Now in Sight.

Miners are Bullish, as one lucky miner gets the 6.25 BTC reward when he only had a 1 in 1,400,000 chance of it happening.

Two days ago I told you that the $40K-42K range seemed to be replacing the $46K-$52K range in which the Bitcoin price had been since the beginning of December 2021. Some people were panicking that the price of Bitcoin would break through the $40K resistance and head South.

The South is the $30K that would take Bitcoin out of the current Bull Market. At the time I explained that this was not the scenario I saw. There were several indications that the bottom of the Bitcoin correction was very close.

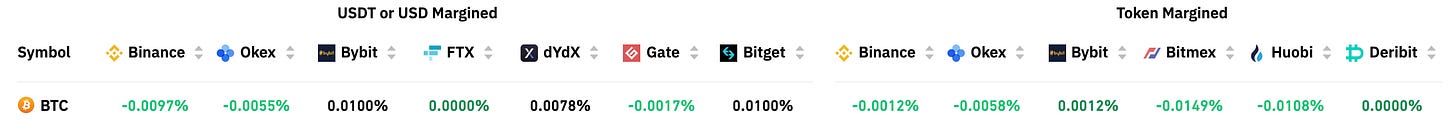

The most telling indicator was the funding rates, which were negative on the majority of trading platforms. This signaled an imminent short squeeze. This moderately took place, but at least it broke out of the $40K-$42K range. Bitcoin's price went as high as $44.4K a few hours ago.

At the time of writing, the price of Bitcoin is hovering around $42.9K. Bitcoin's funding rates are still Bullish:

This bodes well. America's inflation numbers for December 2021 were just released. Inflation hit 7%, the highest level in 40 years. However, this was something to be expected, and the fact that this inflation remains at the analyst consensus level of 7% has finally reassured the markets.

The S&P 500 and the Dow Jones are still at record highs, and Bitcoin, which has already corrected by 40% since its ATH of $69K in November 2021, has already taken on board the fact that the Fed will accelerate the inflection of its ultra-accommodating monetary policy. This risk, therefore, seems to be under control in the short term. We will see what happens next.

In terms of technical analysis, here are the crucial levels to watch in the coming days:

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.