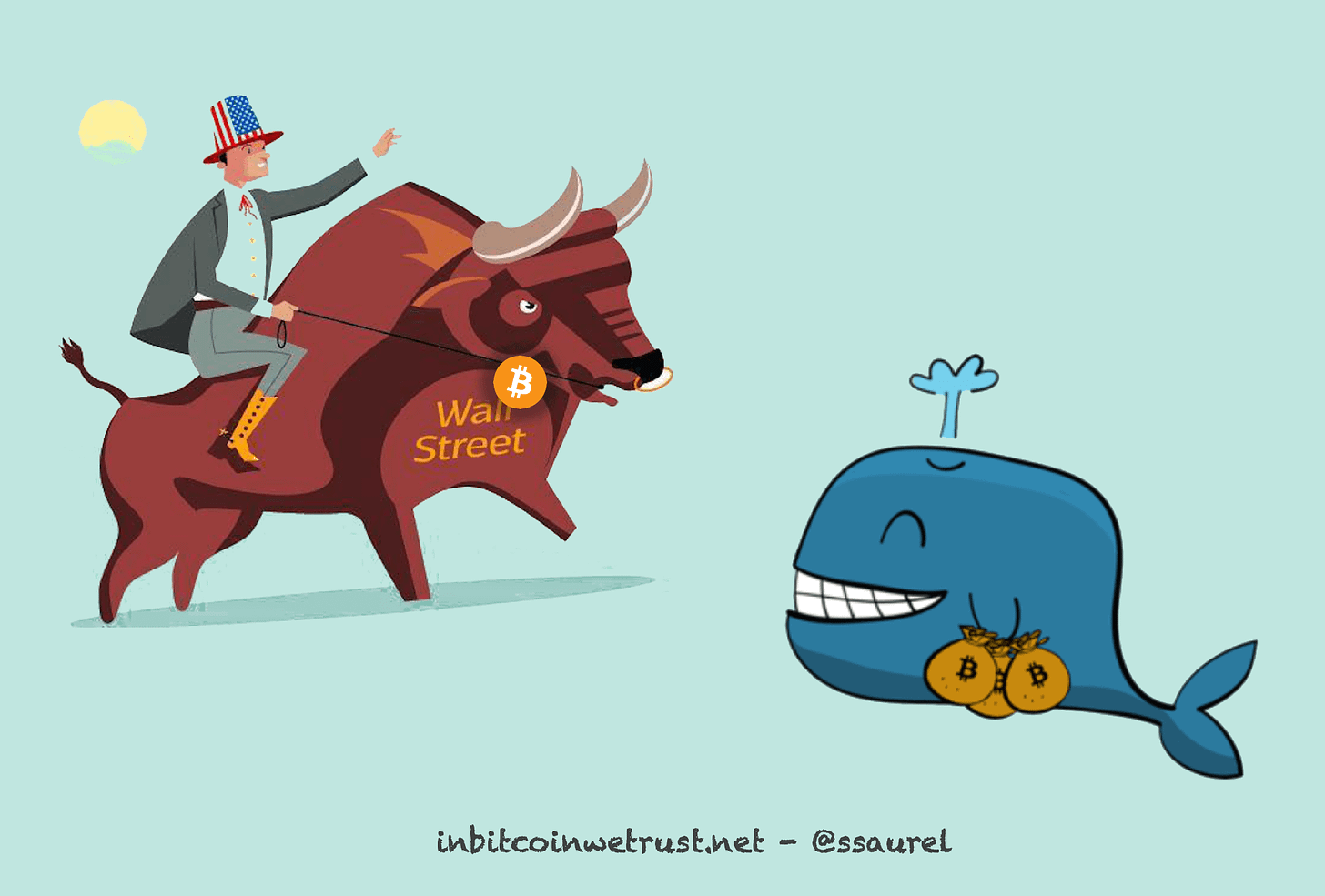

Bitcoin Continues Its Rally Supported by Institutional Who Are Gaining the Upper Hand Over Whales

The current bull rally never seems to end.

Since Bitcoin price has crossed the $20K mark, the bull rally we have been experiencing since the beginning of October 2020 has not faltered. On the contrary, it has even intensified. The $20K was a real psychological barrier.

Once this psychological barrier was overcome, Bitcoin entered uncharted territory. Bitcoin is currently i…

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.