Bitcoin at a Crossroads: With the Shadow of $100K Dispelled, Is the Path to $160K Open?

The battle for control of the market has begun, and the coming weeks promise to be decisive.

The cryptocurrency market is a theater of intense emotions, where fear and euphoria follow one another at a breathtaking pace. The month of September was no exception for Bitcoin (BTC). After an anxiety-inducing drop below the psychological threshold of $110,000, which sent shivers down many an investor’s spine, the king of digital assets demonstrated remarkable resilience. Not only did it reclaim this level, but it closed the month on a positive note, posting a 5% gain. As the spotlight turns to October, a burning question is on everyone’s mind: Is this recovery the prelude to a new bullish explosion, or merely a reprieve before a deeper correction?

History and seasonality lean in favor of the optimists. October, affectionately nicknamed “Uptober” by the crypto community, is historically a prosperous month for Bitcoin. For the past six years, without exception, BTC has ended this month in the green. The statistic is even more telling: the average gain during this period stands at an impressive 20%. If history were to repeat itself, simply adhering to this seasonality would propel the price far beyond its all-time high.

But financial markets are not an exact science, and past performance does not guarantee future results. Are the current conditions still in the buyers’ favor? Does the bull run’s engine still have enough fuel to aim for new heights? In this in-depth analysis, we will dissect the on-chain signals, technical indicators, and market sentiment to determine if Bitcoin is still in a favorable configuration for a continued ascent in the coming weeks.

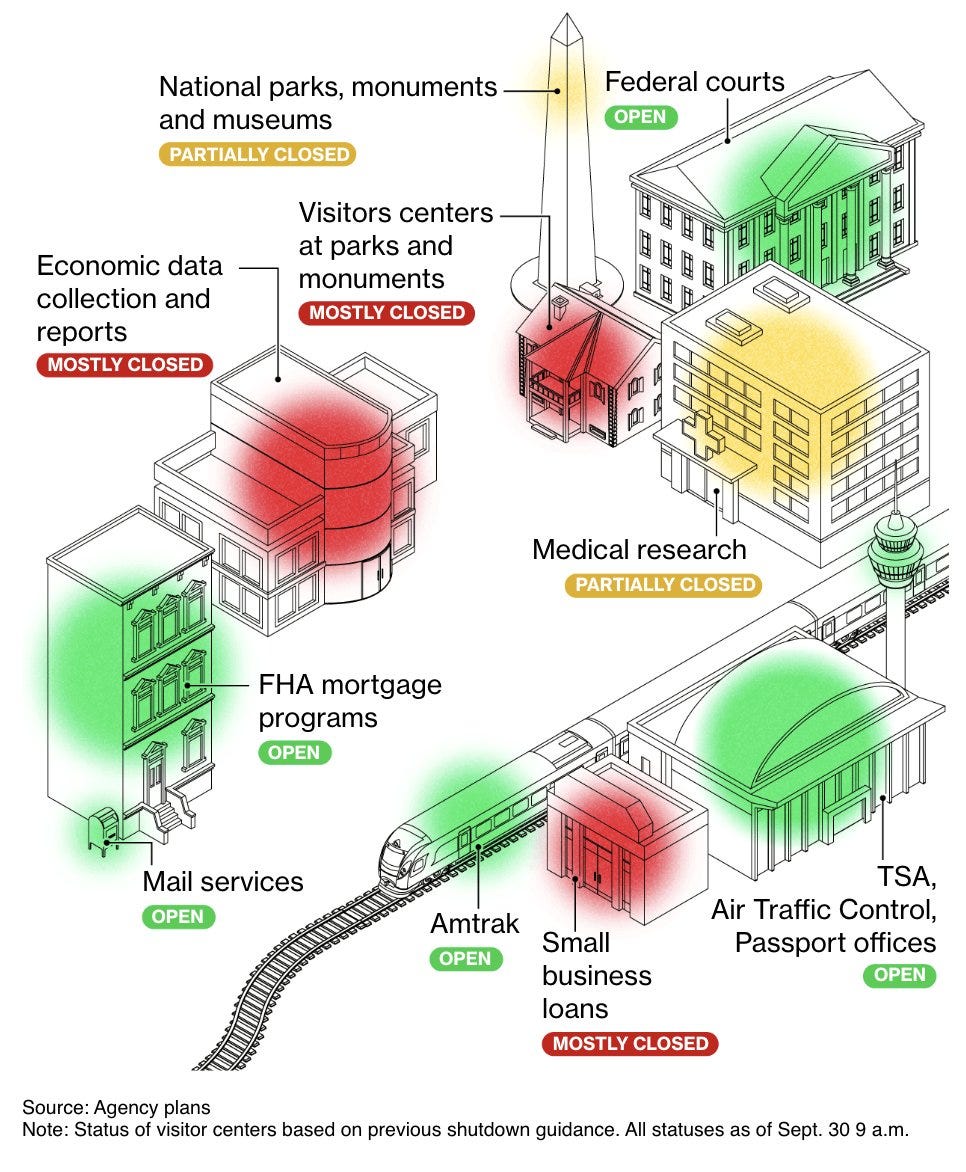

The Shutdown Charade: Why Wall Street Secretly Welcomes Washington’s Dysfunction.

The chaos in Washington is no longer a bug; for investors, it has become a feature.

Keep reading with a 7-day free trial

Subscribe to In Bitcoin We Trust Newsletter to keep reading this post and get 7 days of free access to the full post archives.